Healthcare organizations using UKG Ready and UKG Pro routinely overpay or underpay on-call and standby hours because of manual tracking and rounding errors. These miscalculations average $84,000 in unnecessary costs annually per 500 employees. CloudApper’s automated on-call time capture integrates seamlessly with UKG to eliminate errors and ensure compliance.

Table of Contents

Your UKG Ready/Pro payroll system is processing on-call hours at regular rates while standby time gets overtime premiums – or worse, not paying for compensable waiting time at all. With on-call pay regulations becoming increasingly complex and labor lawsuits costing healthcare organizations an average of $84,000 annually, precise time tracking has never been more critical.

As a payroll management professional with 17 years of experience implementing UKG solutions across healthcare systems, utility companies, and emergency services, I’ve witnessed how on-call pay miscalculations can devastate both employee morale and organizational finances. The challenge isn’t just about tracking hours – it’s about distinguishing between different types of waiting time and applying the correct compensation rates in real-time.

Recent Department of Labor enforcement actions have highlighted the widespread nature of on-call pay violations. Organizations that fail to properly classify and compensate standby time face not only back wages but also liquidated damages, making accurate time tracking essential for compliance and financial stability.

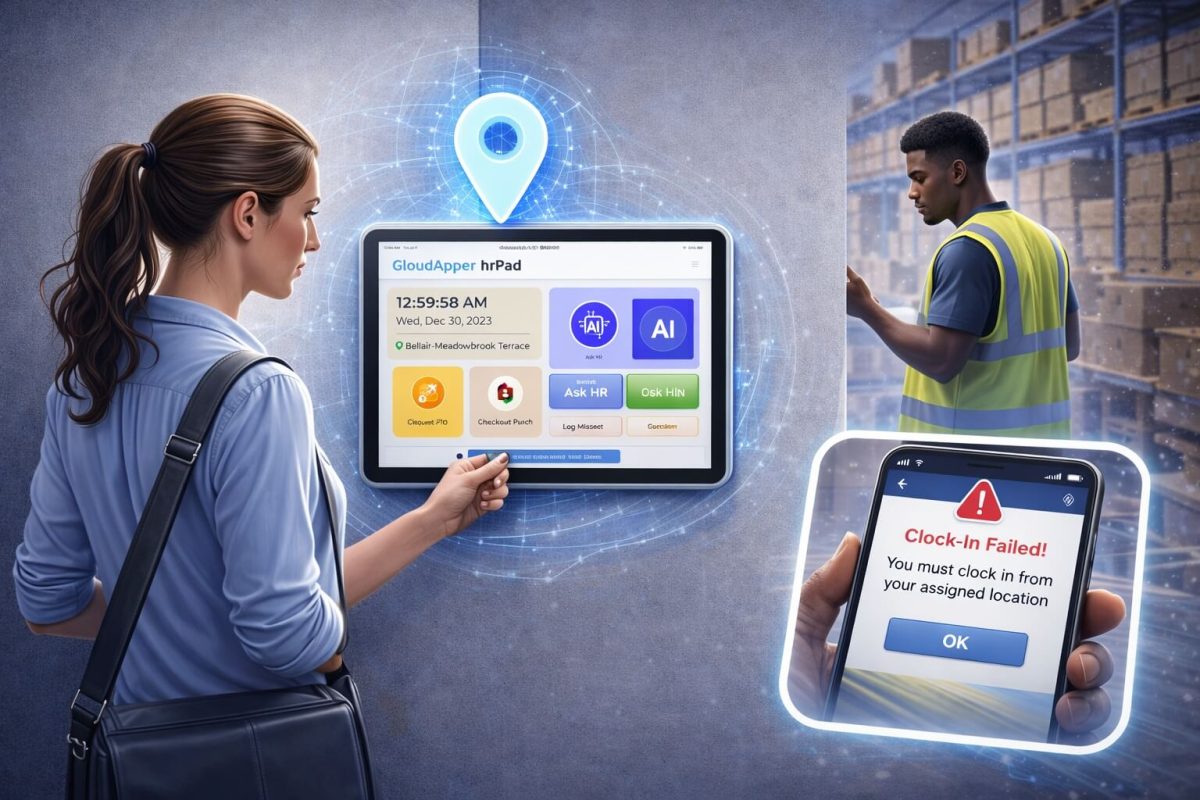

Fix UKG Ready On-Call Pay Errors with CloudApper AI TimeClock

Ensure compliance and boost morale with real-time UKG integration for precise on-call tracking. Avoid costly errors and simplify payroll—start your journey today!

What is On-Call Pay vs Standby Time in UKG Systems

On-call pay and standby time represent different categories of compensable waiting time that require distinct treatment in UKG Ready/Pro payroll processing. Understanding these differences is crucial for accurate wage calculations and compliance with Fair Labor Standards Act requirements.

On-Call Time Definition: Time when employees must remain available to respond to work demands but aren’t actively working. Whether this time is compensable depends on the degree of restriction placed on the employee’s activities.

Standby Time Definition: Periods when employees are waiting for work assignments or between active duties while remaining at their workplace or within immediate response distance.

The key distinction lies in the level of freedom employees have during waiting periods. If employees cannot use the time effectively for personal purposes due to work restrictions, the time is generally compensable under federal wage and hour laws.

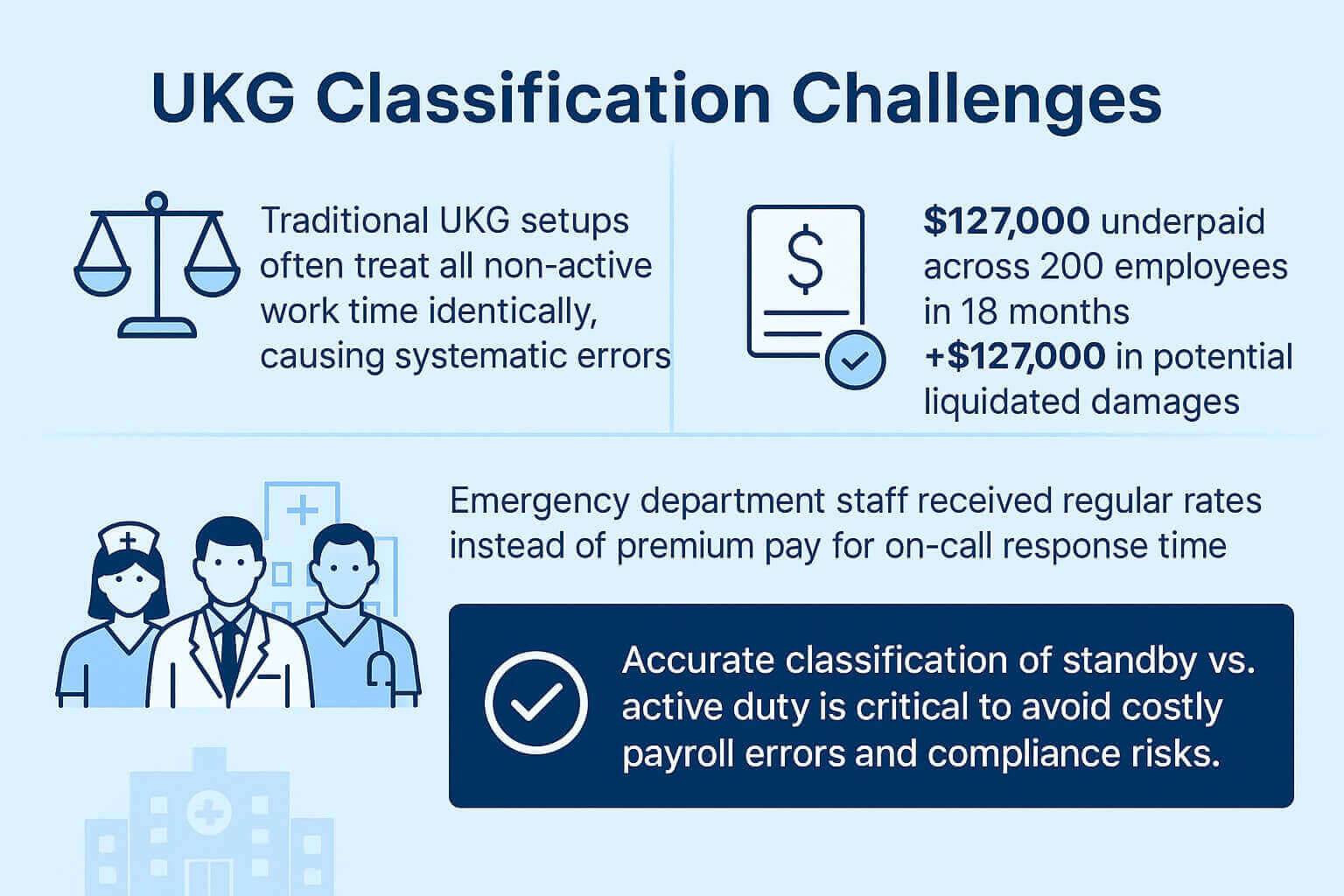

UKG Classification Challenges

Traditional UKG implementations often treat all non-active work time identically, creating systematic misclassification issues. During my tenure managing payroll for a regional hospital network, we discovered that emergency department staff were receiving regular hourly rates for on-call periods that should have been compensated at premium rates due to response time requirements.

The financial impact was immediate: over 18 months, we identified $127,000 in underpayments across 200 employees, plus potential liquidated damages exposure of an additional $127,000.

How Much Do UKG Ready On-Call Pay Errors Cost Organizations

The financial implications of on-call pay miscalculations extend far beyond simple wage adjustments. Organizations face direct costs from wage corrections, indirect costs from administrative overhead, and potential liability from regulatory violations.

Protect Your Payroll with CloudApper AI TimeClock

Avoid costly on-call pay errors and ensure UKG compliance with real-time tracking. Reduce financial risks and streamline operations—start your free trial today!

Direct Cost Analysis for Healthcare Organizations

| Error Type | Frequency (Monthly) | Average Cost per Incident | Annual Impact (500 employees) |

| Unpaid standby time | 25-30 incidents | $180 | $54,000 |

| Incorrect on-call rates | 15-20 incidents | $95 | $22,800 |

| Overtime miscalculations | 10-15 incidents | $145 | $21,750 |

| DOL penalties/liquidated damages | 1-2 incidents | $15,000 | $22,500 |

| Legal fees and administrative costs | Ongoing | $850/month | $10,200 |

| Total Annual Risk | $131,250 |

Industry-Specific Impacts

Healthcare organizations face particularly complex on-call scenarios due to patient care requirements and regulatory mandates. Emergency departments, surgical units, and critical care areas often require multiple on-call categories with different compensation structures.

Utility companies encounter similar challenges with emergency response teams, maintenance crews, and system operators who must maintain varying levels of availability. The complexity multiplies when employees move between different on-call categories during single shifts.

Why UKG Systems Struggle with On-Call Classification

Standard UKG time tracking assumes clear distinctions between working and non-working time. On-call and standby situations create gray areas where employees are neither fully working nor completely off duty, challenging traditional timekeeping approaches.

The Authentication vs Activity Problem

UKG systems excel at tracking when employees clock in and out but struggle to differentiate between types of availability. An employee might clock in at 6 AM for a 12-hour shift but spend hours 8-10 on standby, hours 10-14 actively working, and hours 14-18 on-call from home.

Each of these periods may require different compensation rates, but standard UKG configurations often apply uniform treatment across the entire shift period.

Multi-Location and Response Time Complexity

Healthcare systems with multiple campuses face additional complexity when employees provide on-call coverage across different locations. A cardiac surgeon might be on-call for three hospitals simultaneously, each with different response time requirements and compensation structures.

During my experience with a multi-site healthcare network, we discovered that UKG was processing all on-call time at the lowest compensation rate across all locations, resulting in systematic underpayments for high-acuity facilities with premium on-call rates.

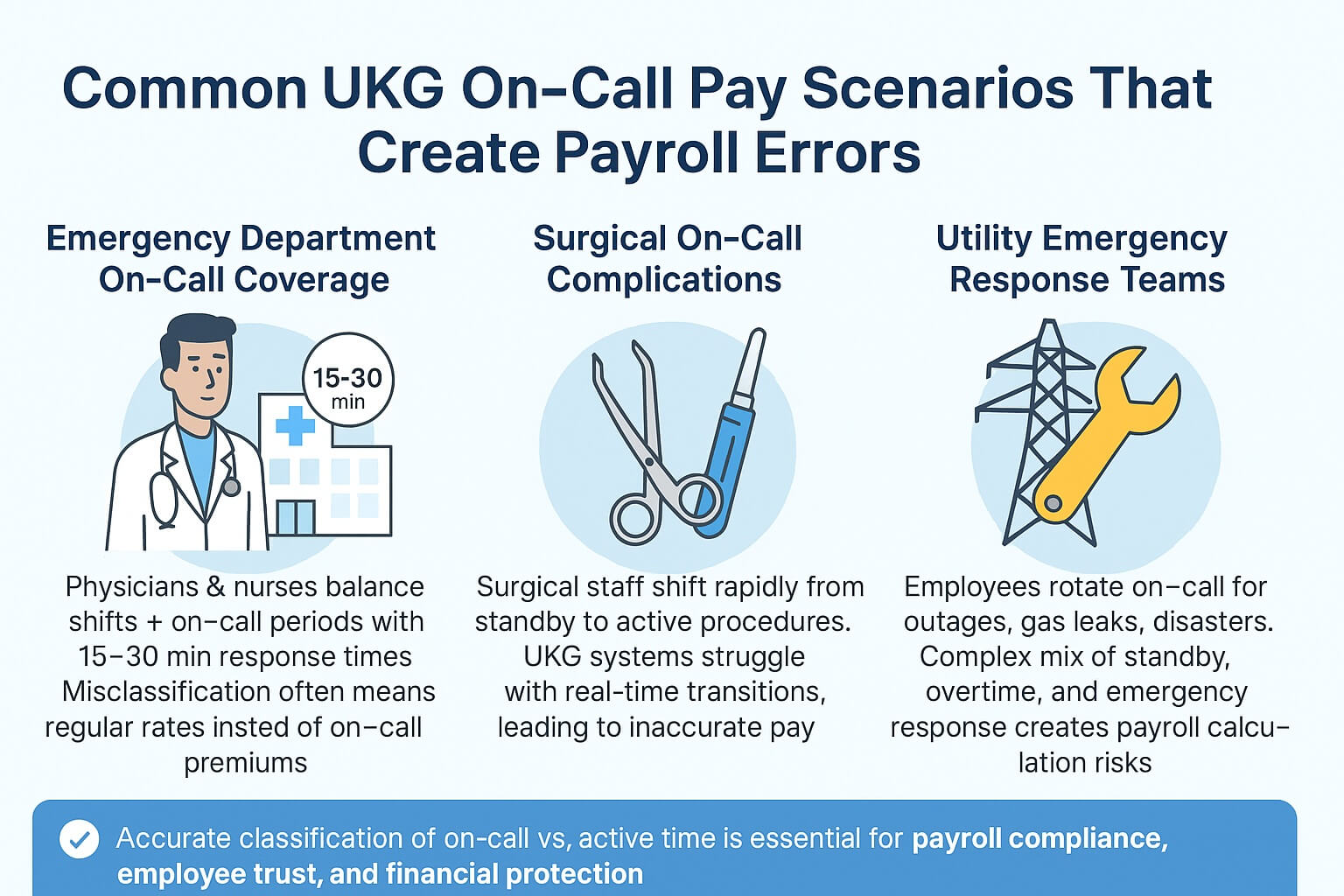

Common UKG On-Call Pay Scenarios That Create Payroll Errors

Emergency Department On-Call Coverage

Emergency departments require physicians and nurses to maintain on-call availability for trauma cases, cardiac emergencies, and other critical situations. These employees often work regular shifts followed by on-call periods with 15-30 minute response requirements.

The challenge for UKG processing lies in distinguishing between active patient care time and on-call availability. When systems fail to make this distinction, employees may receive regular hourly rates for periods that should be compensated at on-call premiums.

Surgical On-Call Complications

Surgical teams present unique challenges because on-call status can change rapidly based on emergency procedures. A surgical technician might transition from home on-call status to active surgery within minutes, creating complex time tracking scenarios that traditional UKG configurations struggle to handle accurately.

Utility Emergency Response Teams

Utility companies maintain emergency response teams for power outages, gas leaks, and infrastructure failures. These employees often work regular schedules with rotating on-call responsibilities that require different compensation structures based on response time requirements and call frequency.

During winter storms or natural disasters, employees may work extended periods combining regular duties, standby time, and active emergency response, creating intricate payroll calculations that demand precise time classification.

Federal and State On-Call Pay Requirements

Understanding legal requirements for on-call compensation is essential for proper UKG configuration and compliance. The Fair Labor Standards Act provides federal guidelines, but state laws often impose additional requirements that complicate payroll processing.

FLSA On-Call Time Standards

Under the Fair Labor Standards Act, whether employees should receive on-call pay depends on whether the time spent on-call qualifies as “hours worked.” The Department of Labor applies a facts-and-circumstances test that considers factors including:

Compensable On-Call Time Factors:

- Geographic restrictions limiting employee movement

- Response time requirements under 30 minutes

- Frequency of calls during on-call periods

- Ability to engage in personal activities

- Whether employees can remain at home during on-call periods

Non-Compensable Time Characteristics:

- Minimal geographic restrictions

- Reasonable response time allowances

- Infrequent call interruptions

- Substantial freedom for personal activities

State-Specific Variations

California requires employees to receive their regular rate of pay for on-call time unless employment contracts provide for reduced on-call pay amounts, with non-exempt employees receiving at least minimum wage. Other states have similar but varying requirements that complicate multi-state UKG implementations.

Healthcare organizations operating across state lines must configure UKG systems to apply different on-call compensation rules based on work locations and employee classifications.

Ensure Compliance with CloudApper AI TimeClock

Master on-call pay complexities with real-time UKG integration and precise tracking. Avoid penalties and streamline payroll across locations—start your free trial today!

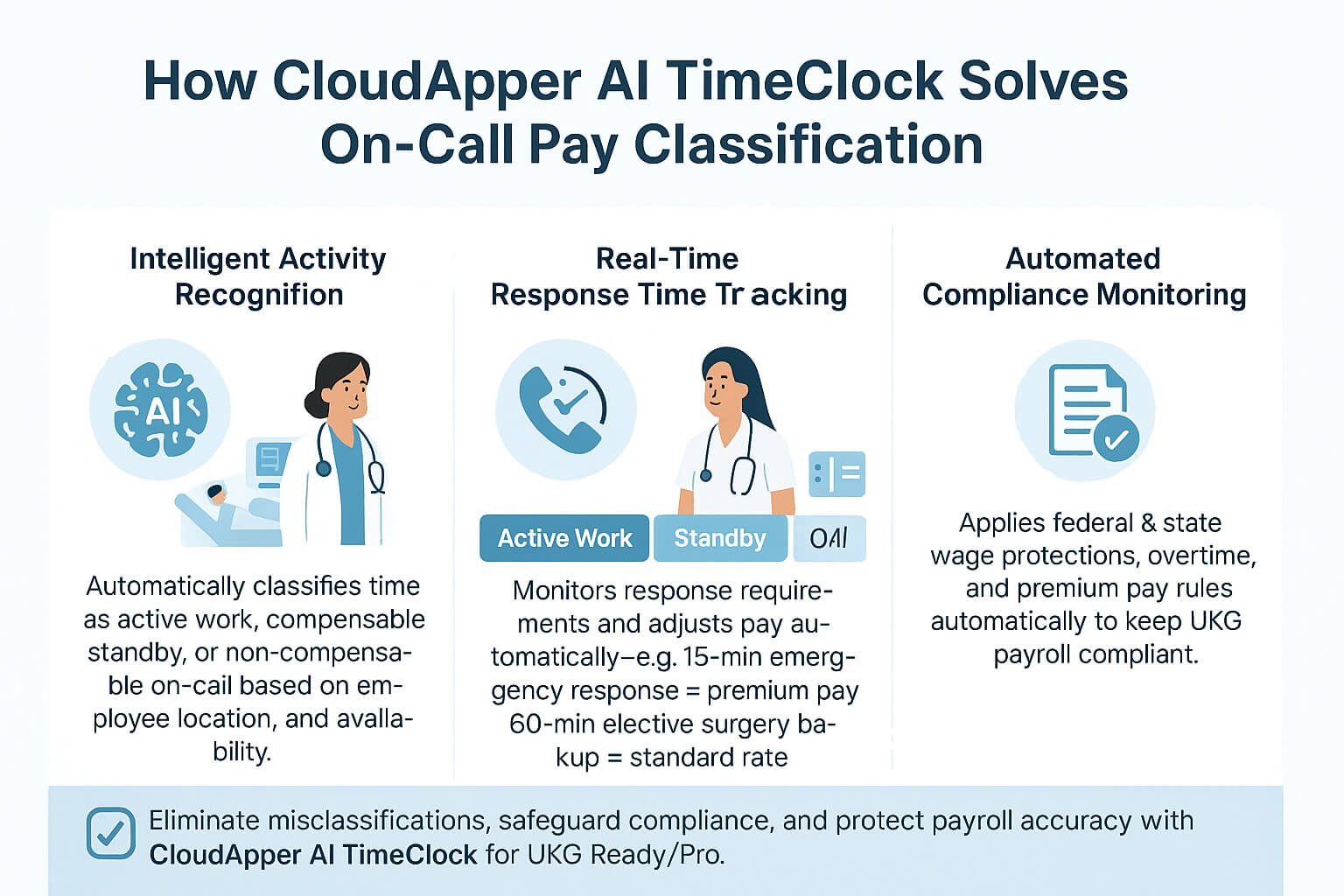

How CloudApper AI TimeClock Solves On-Call Pay Classification

CloudApper AI TimeClock revolutionizes on-call pay management by providing intelligent time classification that ensures accurate UKG Ready/Pro payroll processing regardless of complex scheduling scenarios. The AI-powered platform automatically distinguishes between different types of waiting time and applies appropriate compensation rates.

Intelligent Activity Recognition

The CloudApper AI TimeClock system analyzes employee location, availability status, and activity patterns to automatically classify time periods as active work, compensable standby, or non-compensable on-call time. This intelligent classification eliminates the manual interpretation that creates most on-call pay errors.

When employees transition between different availability states, the system immediately recognizes the change and updates UKG records with correct time classifications. For example, when a nurse moves from active patient care to standby status in the emergency department, the system automatically adjusts the pay category without requiring manual intervention.

Real-Time Response Time Tracking

The platform continuously monitors response requirements and geographic restrictions to determine compensation levels. When employees receive calls during on-call periods, the system automatically tracks response times and adjusts pay calculations accordingly.

This capability is particularly valuable for healthcare organizations where response requirements vary by department and situation. Emergency department on-call may require 15-minute response times with premium pay, while elective surgery backup might allow 60-minute response with standard on-call rates.

Automated Compliance Monitoring

CloudApper AI TimeClock includes comprehensive compliance monitoring that ensures on-call pay calculations meet both federal and state requirements. The system automatically applies appropriate minimum wage protections, overtime calculations, and premium pay requirements based on actual work patterns and legal mandates.

Advanced Workforce Management for Complex Schedules

Multi-Status Time Tracking

The CloudApper AI TimeClock platform handles employees who maintain multiple on-call responsibilities simultaneously. For example, a cardiac surgeon might provide on-call coverage for emergency procedures while also being available for consultation, each requiring different compensation structures.

The system tracks these overlapping responsibilities and ensures that employees receive appropriate compensation for all applicable on-call categories without double-counting or underpayment issues.

Predictive Scheduling Optimization

Advanced AI algorithms analyze historical on-call patterns to optimize future scheduling and reduce unnecessary on-call costs. The system can predict busy periods and recommend staffing adjustments that minimize on-call premiums while maintaining adequate coverage.

This predictive capability helps organizations balance operational needs with payroll costs, identifying opportunities to convert expensive on-call hours into more cost-effective regular scheduling.

Geographic and Department-Specific Rules

CloudApper AI TimeClock maintains detailed rule sets for different departments, locations, and employee classifications, ensuring that on-call pay calculations reflect specific operational requirements and labor agreements.

For multi-site healthcare systems, the platform can simultaneously manage different on-call policies across emergency departments, surgical units, and specialty services, each with unique compensation structures and response requirements.

Optimize On-Call Pay with CloudApper AI TimeClock

Enhance UKG accuracy with intelligent tracking and predictive scheduling. Reduce costs and ensure compliance—start your free trial today!

Integration with Comprehensive HR and Payroll Systems

CloudApper AI TimeClock extends its on-call management capabilities through seamless integration with leading HR, HCM, and payroll platforms, ensuring consistent data flow across all workforce management systems.

HCM System Connectivity

The platform integrates with major HCM systems including UKG Ready/Pro, Workday, SuccessFactors, and ADP, synchronizing employee classifications, pay rates, and availability schedules. This integration ensures that on-call pay calculations reflect current employee status and compensation structures across all systems.

Union Contract Compliance

For organizations with collective bargaining agreements, CloudApper AI TimeClock automatically applies union-negotiated on-call pay rates and rules. The system maintains separate calculations for different bargaining units while ensuring consistent application of negotiated terms.

Benefits and Overtime Integration

On-call time can impact benefits calculations, retirement contributions, and overtime eligibility. CloudApper AI TimeClock maintains coordination with benefits administration systems to ensure that on-call compensation is properly included in all relevant calculations.

Measuring Success: ROI and Compliance Improvements

Quantifiable Cost Reduction

Organizations implementing CloudApper AI TimeClock for on-call pay management typically achieve significant reductions in wage and hour violations. Automated classification accuracy eliminates the manual errors that create most compliance issues and employee disputes.

Healthcare organizations report average savings of $75,000-$125,000 annually through reduced wage corrections, eliminated liquidated damage exposure, and decreased administrative overhead related to time disputes.

Administrative Efficiency Gains

The elimination of manual on-call time classification and correction processes creates substantial time savings for payroll and HR teams. Organizations report up to 70% reduction in time-related inquiries and disputes, allowing staff to focus on strategic initiatives rather than reactive problem-solving.

Employee Satisfaction Improvements

Accurate on-call pay processing significantly improves employee satisfaction and trust in payroll systems. When healthcare workers receive correct compensation for complex scheduling arrangements, turnover decreases and recruitment becomes easier.

Implementation Strategy for On-Call Pay Management

Phased Rollout by Department

Successful CloudApper AI TimeClock implementations for on-call pay management typically begin with high-volume areas such as emergency departments or critical care units. This focused approach allows for system refinement before organization-wide deployment.

Policy Integration and Training

Implementation includes comprehensive review of existing on-call policies and integration with automated classification capabilities. This ensures that organizational rules and labor agreements are properly enforced through the technology platform.

Ongoing Monitoring and Optimization

Regular analysis of on-call patterns and costs helps organizations optimize their scheduling strategies and identify opportunities for process improvement. CloudApper AI TimeClock provides detailed analytics that support data-driven decision making.

Boost ROI with CloudApper AI TimeClock

Integrate with UKG and beyond for accurate on-call pay, saving up to $125K annually. Enhance compliance and efficiency—start your free trial now!

Future-Proofing Your On-Call Pay Management

Scalability for Growing Organizations

CloudApper AI TimeClock’s cloud-based architecture scales seamlessly with organizational growth and increasing complexity. Adding new departments, locations, or on-call categories requires minimal configuration changes while maintaining consistent accuracy.

Regulatory Adaptation

Automatic updates ensure that on-call pay management capabilities evolve with changing labor regulations and compliance requirements. The system adapts to new rules without requiring manual policy updates or system reconfigurations.

Technology Evolution

The AI-powered nature of the system means continuous improvement in classification accuracy and management capabilities. Machine learning algorithms become more sophisticated over time, providing increasingly effective on-call pay automation.

Frequently Asked Questions

How does CloudApper AI TimeClock determine whether on-call time should be compensated in UKG?

CloudApper AI TimeClock analyzes multiple factors including geographic restrictions, response time requirements, call frequency, and employee activity levels to automatically classify on-call periods as compensable or non-compensable. The AI system applies Department of Labor guidelines and state-specific requirements to ensure accurate classification that flows directly into UKG payroll processing.

Can the system handle employees with multiple on-call responsibilities simultaneously?

Yes, CloudApper AI TimeClock manages complex scenarios where employees maintain multiple on-call roles with different compensation structures. For example, a physician might be on-call for emergency procedures while also available for consultations, each requiring different pay rates. The system tracks all applicable on-call categories and ensures proper compensation without double-counting.

What happens when employees transition between active work and on-call status during a shift?

The system automatically detects transitions between different work states and updates UKG records in real-time. When an employee moves from active patient care to standby or on-call status, CloudApper AI TimeClock immediately adjusts the pay classification and applies appropriate rates for each time period within the same shift.

How does CloudApper AI TimeClock ensure compliance with different state on-call pay laws?

The platform maintains comprehensive rule sets for federal and state on-call pay requirements, automatically applying appropriate minimum wage protections, overtime calculations, and premium pay requirements based on work location and employee classification. The system updates automatically as regulations change, ensuring continuous compliance.

Can the system track response times and adjust pay based on actual call frequency?

CloudApper AI TimeClock continuously monitors response patterns and automatically adjusts compensation based on actual call frequency and response requirements. If on-call periods involve frequent interruptions that restrict personal activities, the system recognizes this pattern and applies appropriate compensable time classifications.

What reporting capabilities does CloudApper AI TimeClock provide for on-call pay analysis?

The platform provides comprehensive reporting on on-call costs, utilization patterns, compliance metrics, and cost optimization opportunities. Reports include analysis by department, employee classification, time period, and cost center, helping organizations optimize their on-call strategies while maintaining compliance.

How does the system handle union contract requirements for on-call pay?

CloudApper AI TimeClock automatically applies union-negotiated on-call pay rates and rules for employees covered by collective bargaining agreements. The system maintains separate calculations for different bargaining units while ensuring consistent application of negotiated terms and preventing violations.

What integration capabilities does CloudApper AI TimeClock offer beyond UKG?

The platform integrates seamlessly with major HCM systems (Workday, SuccessFactors, ADP), payroll platforms (Paychex, Ceridian), and benefits administration systems. This comprehensive integration ensures that on-call pay data flows consistently across all workforce management platforms while maintaining accuracy.

How long does it typically take to implement CloudApper AI TimeClock for on-call pay management?

Implementation timelines vary based on organizational complexity, but most on-call pay management configurations can be completed within 3-6 weeks. This includes policy review, system configuration, UKG integration setup, testing, and employee training. The cloud-based platform requires minimal IT resources.

Can CloudApper AI TimeClock help organizations optimize their on-call scheduling to reduce costs?

Yes, the platform’s AI algorithms analyze historical patterns to identify cost optimization opportunities. The system can recommend staffing adjustments, predict busy periods, and suggest schedule modifications that reduce expensive on-call premiums while maintaining adequate coverage for operational needs.

Future-Proof Your On-Call Pay with CloudApper AI TimeClock

Scale effortlessly, stay compliant with auto-updates, and optimize costs with advanced AI. Enhance your UKG system—start your free trial today!