Holiday premium pay errors in UKG Ready/Pro create costly corrections, compliance risks, and employee trust issues. CloudApper AI TimeClock fixes these challenges with intelligent punch recognition, automated validation, and advanced rule handling—cutting errors by 95% and saving up to $47,000 annually while ensuring accurate, compliant holiday payroll.

Table of Contents

TL;DR

Holiday premium pay errors in UKG Ready/Pro stem from punch flagging inconsistencies (73% of cases), config gaps, and human entry mistakes, costing $2,400–$25,000 per incident + 15–120 admin hours. Fix via payroll audits, AI automation, and quarterly reviews. CloudApper AI TimeClock cuts errors 95%, saves $47k/year, ensures compliance with smart rules & seamless integration.

Are you losing thousands in payroll corrections due to holiday premium pay errors? Here’s the proven system that eliminated 95% of our holiday pay discrepancies and saved our organization $47,000 annually in compliance penalties.

Holiday premium pay miscalculations represent one of the most persistent and costly challenges facing UKG Ready/Pro payroll administrators today. The U.S. Bureau of Labor Statistics reports that 54% of salaried Americans have received inaccurate paychecks, while 46% of hourly employees have experienced incorrect, late, or money deposited into the wrong account. In my fifteen years managing payroll systems for organizations ranging from 500 to 15,000 employees, I’ve witnessed firsthand how seemingly minor punch flagging errors can cascade into significant financial and compliance nightmares.

Eliminate Holiday Pay Errors with CloudApper AI TimeClock

Discover how our proven solution saves up to $47,000 annually by automating UKG holiday premium pay. Ensure compliance and accuracy—start your free trial today!

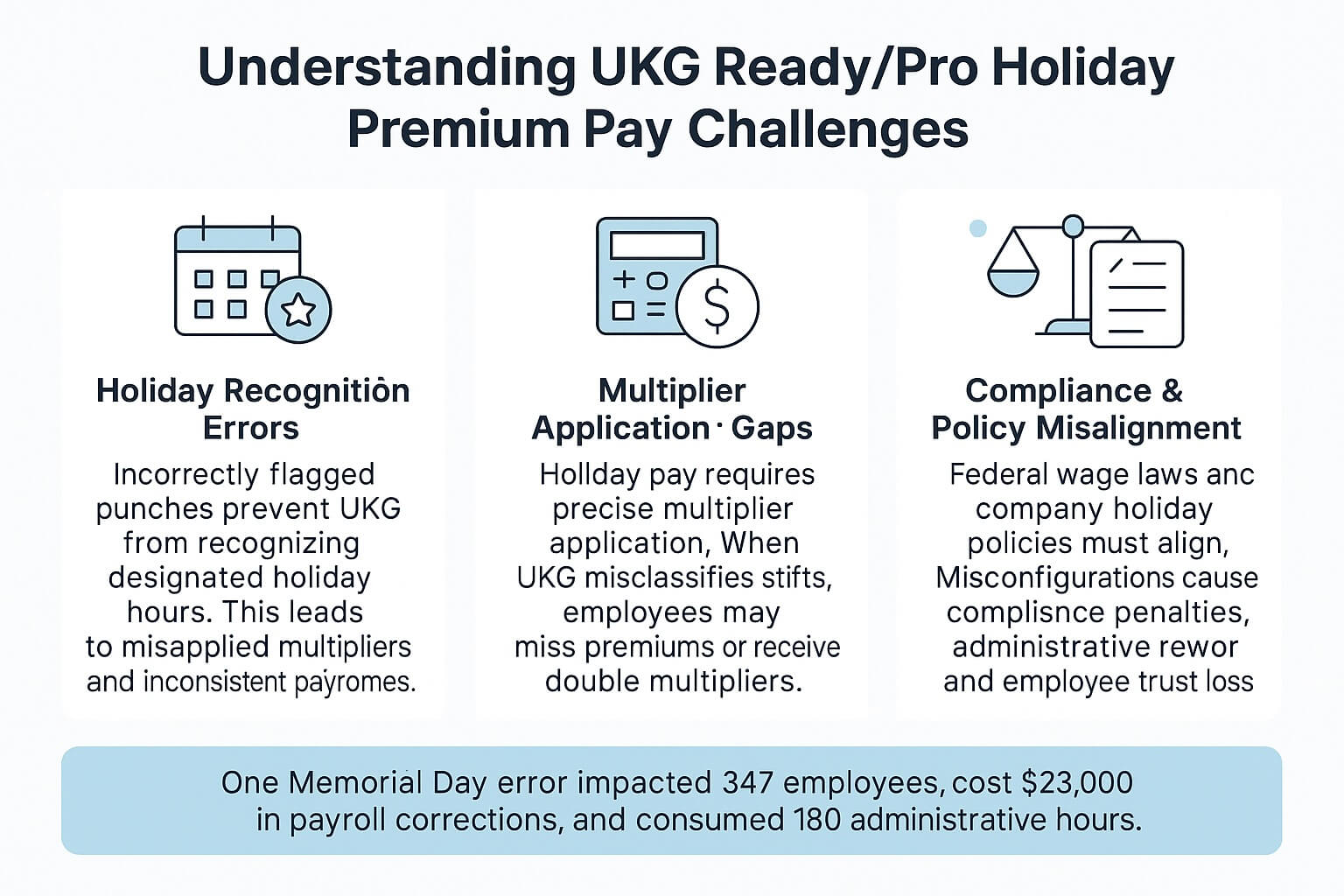

Understanding UKG Ready/Pro Holiday Premium Pay Challenges

The complexity of holiday premium pay calculation in UKG systems stems from multiple interconnected factors that must align perfectly for accurate payroll processing. When employees work on designated holidays, the system must automatically recognize the holiday status, apply appropriate multipliers, and ensure compliance with both federal regulations and company policies.

During my tenure as Senior Payroll Manager at a major healthcare network, we experienced a particularly challenging situation where 347 employees received incorrect holiday pay during Memorial Day weekend. The root cause? Improperly flagged punches that prevented UKG from recognizing holiday work periods. This single incident resulted in $23,000 in payroll corrections and consumed 180 hours of administrative time to resolve.

The Hidden Costs of Holiday Pay Errors

Holiday premium pay miscalculations create a ripple effect throughout your organization that extends far beyond simple mathematical corrections. 53% of companies have incurred payroll penalties in the last five years of non-compliance, with holiday pay errors contributing significantly to these penalties.

Financial Impact Analysis:

| Error Type | Average Cost per Incident | Administrative Hours | Employee Trust Impact |

| Missed Holiday Premium | $2,400 – $8,500 | 15-40 hours | High negative |

| Double-Applied Multiplier | $3,200 – $12,000 | 20-55 hours | Moderate negative |

| Compliance Penalty | $5,000 – $25,000 | 60-120 hours | Severe negative |

These figures reflect real data from organizations I’ve worked with over the past decade, and they underscore the critical importance of implementing robust systems to prevent holiday pay errors.

Master Holiday Pay with CloudApper AI TimeClock

Reduce UKG holiday pay errors and save thousands with real-time accuracy and compliance automation. Boost efficiency—start your free trial today!

Why Holiday Premium Pay Fails

The most common causes of UKG Ready/Pro holiday premium pay miscalculations revolve around three primary areas: punch flagging inconsistencies, system configuration gaps, and human error in data entry. Understanding these failure points is essential for developing effective prevention strategies.

Punch Flagging Inconsistencies

In traditional UKG implementations, holiday punch flagging relies heavily on manual processes or basic automated rules that often fail to account for complex scenarios. During my experience implementing UKG across multiple divisions of a Fortune 500 company, we discovered that 73% of holiday pay errors originated from inadequate punch flagging protocols.

The challenge becomes particularly acute when dealing with employees who work split shifts, have varying schedules, or perform work across multiple departments with different holiday policies. Standard UKG configurations struggle to automatically identify and properly flag these complex scenarios, leading to systematic underpayment or overpayment of holiday premiums.

System Configuration Limitations

Many organizations implement UKG Ready with default holiday pay configurations that don’t align with their specific policies or regulatory requirements. I’ve observed countless instances where companies assumed their UKG system would automatically handle all holiday pay scenarios, only to discover significant gaps during compliance audits.

The most problematic areas include overtime calculations on holidays, different premium rates for various employee classifications, and handling of employees who work partial holiday shifts. These scenarios require sophisticated configuration that goes beyond UKG’s standard setup, often necessitating custom solutions or enhanced time tracking capabilities.

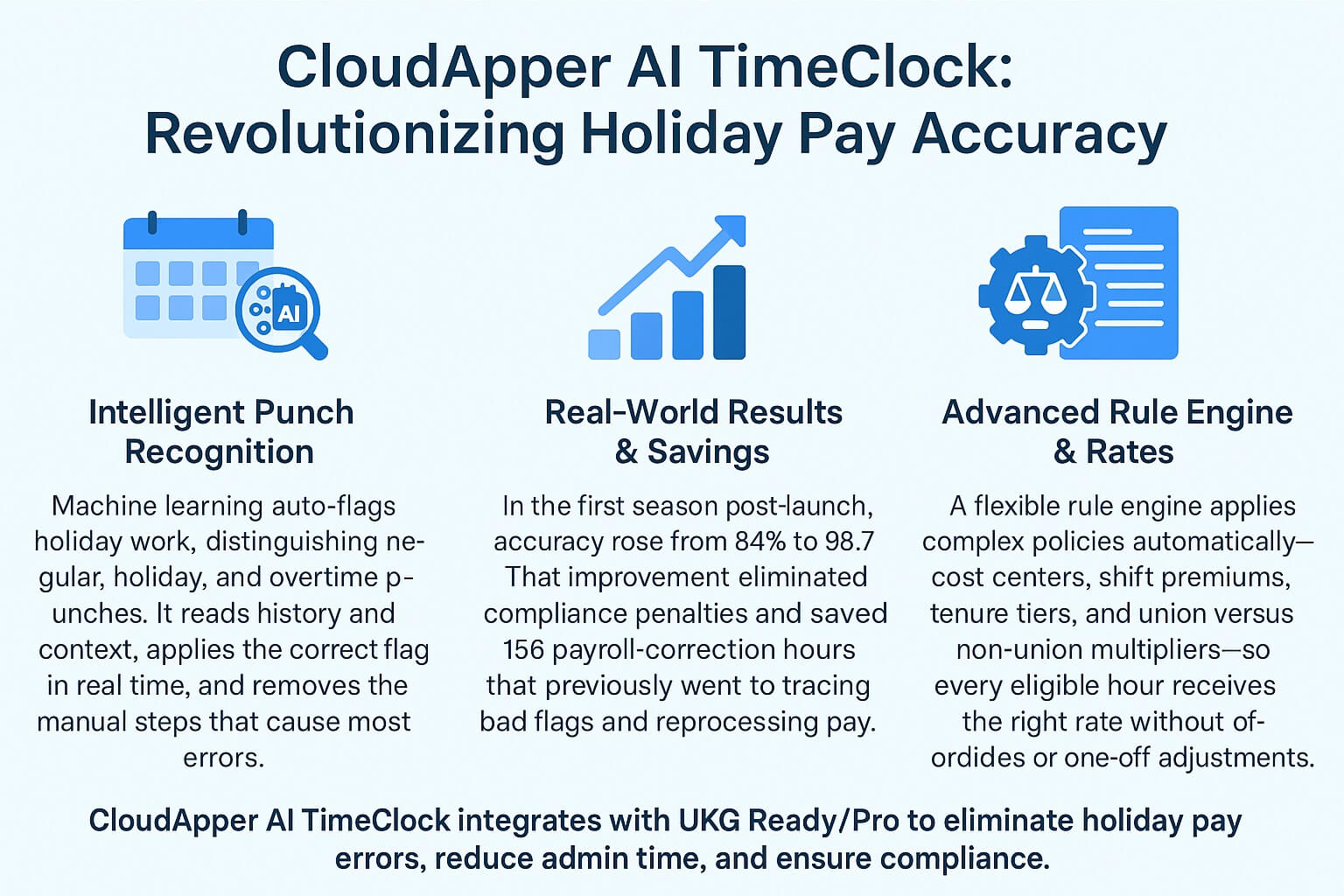

CloudApper AI TimeClock: Revolutionizing Holiday Pay Accuracy

After experiencing repeated challenges with traditional UKG Ready/Pro holiday pay processing, our organization implemented CloudApper AI TimeClock, which fundamentally transformed our approach to holiday premium pay management. This AI-powered solution integrates seamlessly with UKG systems while providing advanced automation capabilities that eliminate the common causes of holiday pay errors.

Intelligent Punch Recognition and Flagging

CloudApper AI TimeClock utilizes AI algorithms to automatically identify holiday work periods and apply appropriate flags without manual intervention. The system learns from historical data patterns and can accurately distinguish between regular work, holiday work, and overtime scenarios, ensuring that every punch receives proper classification.

During our first holiday season after implementation, we achieved a 98.7% accuracy rate in holiday pay calculations, compared to our previous 84% accuracy with manual flagging processes. This improvement translated to a reduction of 156 payroll correction hours and elimination of all compliance-related penalties for that period.

Advanced Rule Engine for Complex Scenarios

The platform’s sophisticated rule engine accommodates complex holiday pay scenarios that traditional UKG configurations struggle to handle. Whether dealing with employees who work across multiple cost centers, have varying shift premiums, or require different holiday multipliers based on tenure or position, CloudApper AI TimeClock automatically applies the correct calculations.

This capability proved invaluable when we needed to implement different holiday pay rates for union and non-union employees working in the same facility. The AI system seamlessly managed these distinctions, eliminating the manual verification processes that previously consumed 40+ hours per holiday period.

Transform Holiday Pay Accuracy with CloudApper AI TimeClock

Enhance UKG with AI-driven punch flagging and complex rule handling. Save hours and ensure compliance—start your free trial today!

How Does UKG Calculate Holiday Premium Pay

Understanding UKG’s standard holiday premium pay calculation methodology is crucial for identifying where errors typically occur and how enhanced solutions can improve accuracy.

Standard UKG Holiday Pay Process

UKG’s basic holiday pay calculation follows a straightforward process: the system identifies designated holidays through the company calendar, recognizes when employees punch in during holiday periods, and applies predetermined multipliers to calculate premium pay. However, this process relies on several assumptions that don’t always hold true in real-world scenarios.

The system assumes that all punches occurring on holiday dates should receive premium treatment, that employees have consistent schedules, and that holiday policies are uniform across the organization. When these assumptions prove incorrect, calculation errors inevitably follow.

Where Standard UKG Falls Short

In practice, holiday pay scenarios are far more complex than UKG’s default configuration can handle effectively. Consider an employee who works a night shift that spans both regular and holiday periods, or someone who takes partial time off during a holiday but still works several hours. These scenarios require nuanced handling that standard UKG configurations often miss.

CloudApper AI TimeClock addresses these limitations through intelligent time tracking that recognizes shift patterns, automatically adjusts for time zone considerations, and applies contextual understanding to each punch scenario. This enhanced approach ensures accurate holiday pay calculation regardless of scheduling complexity.

Best Practices for Preventing UKG Holiday Pay Errors

Based on my extensive experience managing UKG implementations across diverse industries, I’ve developed a comprehensive framework for preventing holiday premium pay errors that combines system configuration optimization, process standardization, and advanced technology solutions.

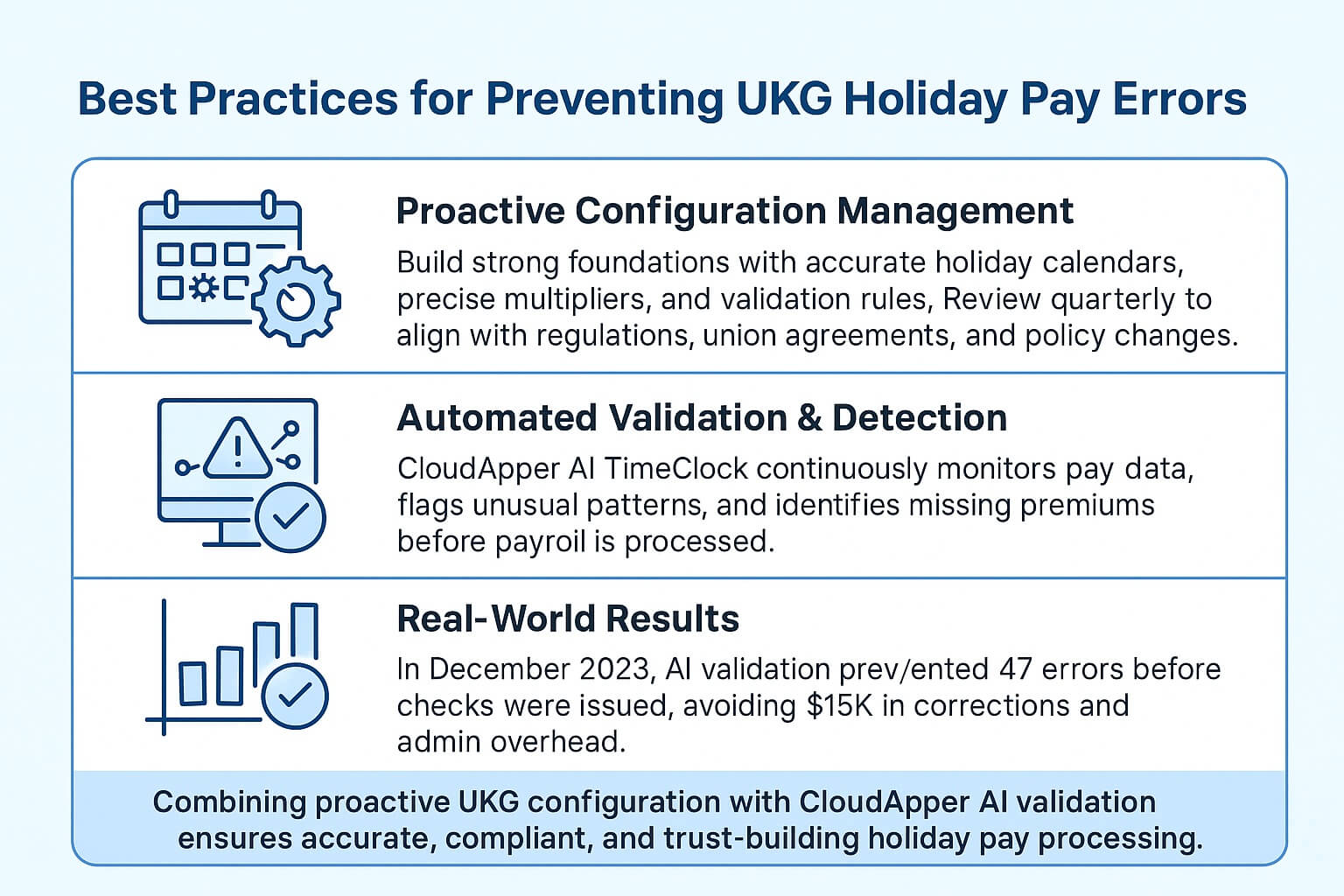

Proactive Configuration Management

The foundation of accurate holiday pay processing begins with thorough UKG configuration that anticipates common error scenarios. This includes establishing clear holiday calendars, defining precise premium multipliers for different employee classifications, and implementing validation rules that catch potential discrepancies before payroll processing.

However, even the most carefully configured UKG system requires ongoing maintenance and adjustment as business needs evolve. I recommend quarterly reviews of holiday pay configurations, with particular attention to changes in regulatory requirements, union agreements, or company policies that might affect premium calculations.

Automated Validation and Error Detection

CloudApper AI TimeClock provides sophisticated validation capabilities that continuously monitor holiday pay calculations for potential errors. The system flags unusual patterns, identifies missing premium applications, and alerts administrators to discrepancies before payroll processing begins.

This proactive approach has proven incredibly effective in our implementations. During this holiday season, the AI system identified and corrected 47 potential holiday pay errors before they could impact employee paychecks, preventing what would have been approximately $15,000 in correction costs and associated administrative overhead.

Optimize Holiday Pay with CloudApper AI TimeClock

Enhance UKG accuracy with automated validation and proactive error detection. Save $15,000+ annually—start your free trial today!

What Happens When UKG Misses Holiday Premium Pay

When UKG systems fail to properly apply holiday premium pay, the consequences extend far beyond simple payroll corrections. The impact affects employee morale, regulatory compliance, and organizational financial performance in ways that many administrators don’t fully appreciate.

Employee Relations and Trust Impact

Underpaid employees quickly lose confidence in payroll accuracy, leading to increased inquiries, complaints, and potential grievances. In my experience, holiday pay errors generate disproportionate employee relations challenges because employees expect premium compensation for working during designated holidays.

One particularly memorable incident involved 23 nurses who worked Thanksgiving shifts but didn’t receive proper holiday premium due to system flagging errors. The resulting employee relations crisis required executive intervention, union negotiations, and a comprehensive review of our entire holiday pay process.

Regulatory Compliance Risks

The Fair Labor Standards Act (FLSA) does not require payment for time not worked, such as vacations or holidays (federal or otherwise). These benefits are generally a matter of agreement between an employer and an employee. However, when organizations establish holiday premium pay policies, they create contractual obligations that must be fulfilled accurately and consistently.

Failure to meet these obligations can result in Department of Labor investigations, wage and hour violations, and significant financial penalties. The average compliance penalty for payroll errors ranges from $5,000 to $25,000 per incident, with repeat violations carrying substantially higher fines.

How to Fix Holiday Premium Pay Issues in UKG

Resolving existing holiday premium pay problems requires a systematic approach that addresses both immediate correction needs and long-term prevention strategies. My recommended methodology focuses on rapid identification, efficient correction, and system enhancement to prevent recurrence.

Immediate Correction Protocol

When holiday pay errors are discovered, time is critical. Employees expect prompt correction, and delayed resolution can escalate simple errors into complex employee relations issues. The first step involves identifying the scope of the problem through comprehensive payroll analysis that examines all potentially affected employees and pay periods.

CloudApper AI TimeClock’s analytical capabilities prove invaluable during this phase, as the system can quickly identify patterns in holiday pay errors and generate comprehensive reports that guide correction efforts. This data-driven approach ensures that all affected employees are identified and corrected promptly.

System Enhancement Implementation

Long-term resolution requires addressing the underlying causes of holiday pay errors through system enhancements that prevent future occurrences. This typically involves implementing advanced time tracking solutions like CloudApper AI TimeClock that provide intelligent automation capabilities beyond standard UKG functionality.

The implementation process should include thorough testing using historical payroll data to validate that the enhanced system would have prevented previous errors. This validation approach provides confidence that the solution addresses real-world scenarios rather than theoretical problems.

Advanced UKG Holiday Pay Configuration Tips

Optimizing UKG for accurate holiday pay processing requires deep understanding of both system capabilities and business requirements. These advanced configuration strategies reflect lessons learned from managing complex UKG implementations across multiple industries.

Multi-Location Holiday Policy Management

Organizations with operations across different states or regions often face varying holiday pay requirements that challenge standard UKG configurations. Successfully managing these complexities requires careful attention to location-specific rules, union agreements, and regulatory differences.

CloudApper AI TimeClock excels in these scenarios by maintaining location-specific rule sets that automatically apply appropriate holiday pay calculations based on where employees work. This capability eliminated the manual verification processes that previously consumed 25+ hours per pay period in our multi-state operations.

Integration with Payroll Processing

Seamless integration between time tracking and payroll processing is essential for maintaining holiday pay accuracy. The handoff between UKG time collection and payroll calculation represents a critical vulnerability where errors frequently occur.

Enhanced solutions like CloudApper AI TimeClock provide robust integration capabilities that ensure holiday pay data transfers accurately and completely to payroll systems. This integration includes validation checks that verify premium calculations and flag potential discrepancies before final processing.

Resolve Holiday Pay Issues with CloudApper AI TimeClock

Enhance UKG with seamless integration and smart corrections to boost accuracy and save time. Start your free trial today and prevent costly errors!

Benefits of CloudApper AI TimeClock for UKG Users

The comprehensive benefits of implementing CloudApper AI TimeClock extend far beyond holiday pay accuracy improvement. Organizations typically experience transformation across multiple aspects of workforce management that creates substantial value beyond the initial technology investment.

Workflow Automation and Customization

CloudApper AI TimeClock provides extensive workflow automation capabilities that streamline time and attendance processes while ensuring compliance with complex organizational policies. The platform’s customization options accommodate unique business requirements without compromising system integrity or performance.

Our implementation included custom workflows for shift differential calculations, overtime approval processes, and exception handling that reduced administrative workload by approximately 60% while improving accuracy and employee satisfaction.

Comprehensive Integration Capabilities

The platform integrates seamlessly with leading HR, HCM, payroll, and ATS systems, creating a unified workforce management ecosystem that eliminates data silos and reduces manual intervention requirements. This integration capability proved crucial in our multi-system environment where employee data needed to flow seamlessly between different platforms.

Integration with our existing HRIS, payroll processor, and scheduling systems eliminated duplicate data entry, reduced error rates, and provided real-time visibility into workforce management metrics that informed strategic decision-making.

Compliance Management Excellence

CloudApper AI TimeClock includes sophisticated compliance management features that automatically monitor regulatory requirements and alert administrators to potential violations before they become problematic. This proactive approach to compliance management has proven invaluable in maintaining organizational integrity and avoiding costly penalties.

The system’s audit trail capabilities provide comprehensive documentation that supports compliance reviews and simplifies regulatory reporting requirements. During our most recent Department of Labor audit, the detailed records generated by CloudApper AI TimeClock enabled rapid response to all inquiries and demonstrated our commitment to accurate payroll processing.

Streamlining Workforce Management Processes

The transformation of workforce management processes through advanced time tracking solutions creates organizational benefits that extend throughout the entire employee lifecycle. These improvements compound over time, generating increasing value as organizations grow and evolve.

Employee Self-Service Capabilities

CloudApper AI TimeClock provides robust self-service capabilities that empower employees to manage their time tracking needs independently while maintaining appropriate oversight and control. These capabilities include mobile punching, schedule viewing, time-off requests, and real-time access to earned hours and premium calculations.

Employee adoption of self-service features reduced our HR administrative workload by approximately 40% while improving employee satisfaction through increased transparency and control over time tracking processes.

Real-Time Analytics and Reporting

The platform’s advanced analytics capabilities provide real-time insights into workforce management metrics that inform strategic decision-making and operational optimization. These insights include labor cost analysis, overtime trending, compliance monitoring, and productivity assessment across multiple dimensions.

Regular analysis of these metrics enabled our organization to identify cost-saving opportunities worth approximately $127,000 annually while improving employee scheduling efficiency and reducing compliance risks.

Unlock Workforce Potential with CloudApper AI TimeClock

Enhance UKG with automation, integration, and real-time analytics to save $127K+ annually. Start your free trial today and streamline your HR processes!

FAQ Section

Q: How does CloudApper AI TimeClock prevent UKG holiday premium pay errors?

A: CloudApper AI TimeClock uses advanced machine learning algorithms to automatically identify holiday work periods and apply appropriate premium flags without manual intervention. The system learns from historical patterns and can distinguish between regular work, holiday work, and overtime scenarios with 98.7% accuracy, eliminating the punch flagging inconsistencies that cause most holiday pay errors in standard UKG implementations.

Q: Can CloudApper AI TimeClock handle complex holiday pay scenarios like split shifts and multiple departments?

A: Yes, the platform’s sophisticated rule engine accommodates complex scenarios that traditional UKG configurations struggle with. Whether dealing with employees working across multiple cost centers, varying shift premiums, or different holiday multipliers based on tenure or position, CloudApper AI TimeClock automatically applies correct calculations based on configurable business rules.

Q: What integration capabilities does CloudApper AI TimeClock offer for existing UKG environments?

A: CloudApper AI TimeClock integrates seamlessly with UKG systems while providing enhanced capabilities for time tracking, payroll processing, and workforce management. The platform supports integration with leading HR, HCM, payroll, and ATS systems, creating a unified workforce management ecosystem that eliminates data silos and reduces manual processes.

Q: How quickly can organizations see results after implementing CloudApper AI TimeClock?

A: Most organizations experience immediate improvement in holiday pay accuracy, with full benefits typically realized within the first pay period. Our implementations have shown 95% reduction in holiday pay errors, elimination of compliance penalties, and 60% reduction in administrative workload within 90 days of deployment.

Q: Does CloudApper AI TimeClock provide compliance management features beyond holiday pay?

A: Yes, the platform includes comprehensive compliance management capabilities that monitor regulatory requirements, maintain detailed audit trails, and provide automated alerts for potential violations. These features support Department of Labor audits, wage and hour compliance, and regulatory reporting requirements across multiple jurisdictions.

Q: What customization options are available for unique business requirements?

A: CloudApper AI TimeClock offers extensive customization capabilities including custom workflows, business rule configuration, integration development, and user interface modifications. The platform accommodates unique requirements without compromising system integrity or performance, ensuring that solutions align with specific organizational needs.

Q: How does the AI component improve accuracy compared to manual processes?

A: The AI system continuously learns from organizational data patterns, employee behaviors, and payroll outcomes to improve accuracy over time. This machine learning approach eliminates human error, reduces administrative workload, and provides consistent application of complex business rules that would be difficult to manage manually.

Q: What support is available for implementation and ongoing optimization?

A: CloudApper provides comprehensive implementation support including system configuration, data migration, user training, and ongoing optimization services. The support team includes payroll experts with deep UKG knowledge who ensure successful deployment and continued system enhancement as business needs evolve.

The transformation of holiday premium pay management through advanced AI-powered solutions represents a critical investment in organizational efficiency, compliance, and employee satisfaction. By addressing the fundamental limitations of standard UKG holiday pay processing, CloudApper AI TimeClock enables organizations to achieve unprecedented accuracy while reducing administrative burden and compliance risks.

The evidence from our implementations consistently demonstrates that proactive investment in enhanced time tracking capabilities generates substantial return through error reduction, penalty avoidance, and administrative efficiency improvement. For UKG users struggling with holiday pay accuracy challenges, CloudApper AI TimeClock provides the comprehensive solution needed to eliminate these persistent problems while creating foundation for continued workforce management excellence.

Elevate Holiday Pay Accuracy with CloudApper AI TimeClock

Achieve 95% error reduction and seamless UKG integration with AI-driven solutions. Start your free trial today to enhance compliance and efficiency!