Survivor benefit processes are some of the most emotionally charged and operationally complex tasks HR teams face and UKG alone isn’t enough. See how CloudApper hrPad automates document collection, approvals, and auditing to give HR professionals control, families peace, and leadership compliance confidence.

Table of Contents

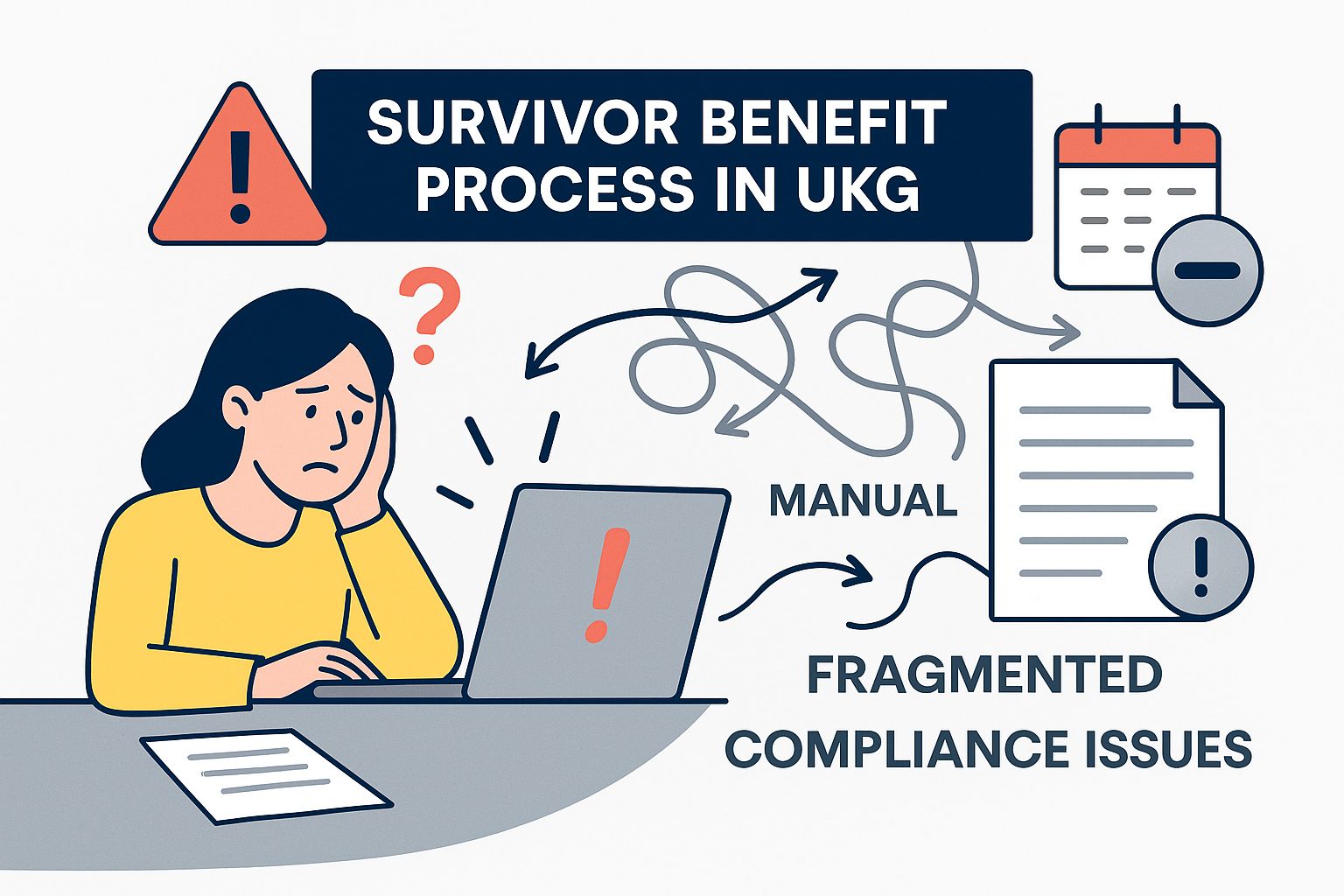

When an employee passes away, the responsibility to process the survivor benefit doesn’t just fall on payroll or benefits — it becomes a test of HR’s ability to act with speed, precision, and compassion. Unfortunately, in many organizations using UKG, the survivor benefit process is still fragmented, manual, and emotionally taxing for everyone involved.

Families are often left in the dark, HR teams juggle emails and spreadsheets, and leadership faces audit risks from missing documentation or inconsistent workflows. Even with UKG handling the data, there’s no built-in system to guide HR through every step — from collecting death certificates to tracking claim approvals and closing benefit files.

“I wasn’t just grieving — I was lost. I didn’t know where to send forms, who to contact, or how long the survivor benefit would take.”

That’s what one employee’s spouse shared with HR after navigating the loss of a loved one — and it’s a story that happens more often than it should.

This gap is more than operational — it’s human. And it’s exactly what CloudApper hrPad is solving.

Where the native system falls short

| Critical Area | UKG Out-of-Box Reality | Operational Impact |

|---|---|---|

| Task routing across Payroll, IT, Benefits, Security | No automated hand-off | Staff rely on ad-hoc e-mails; steps are missed |

| Document collection from beneficiaries | PDFs arrive via Outlook, fax, or mail | Files live in personal folders; no audit chain |

| Claim status visibility | Spreadsheet or sticky notes per case | Leadership cannot see bottlenecks or deadlines |

| Communication history | Calls and e-mails logged separately | Bereaved families repeat information; brand risk |

| Statutory deadline tracking (ERISA, IRS, COBRA) | Calendar alerts | High risk of late notices and financial penalties |

How hrPad fills the survivor-benefit gaps for UKG

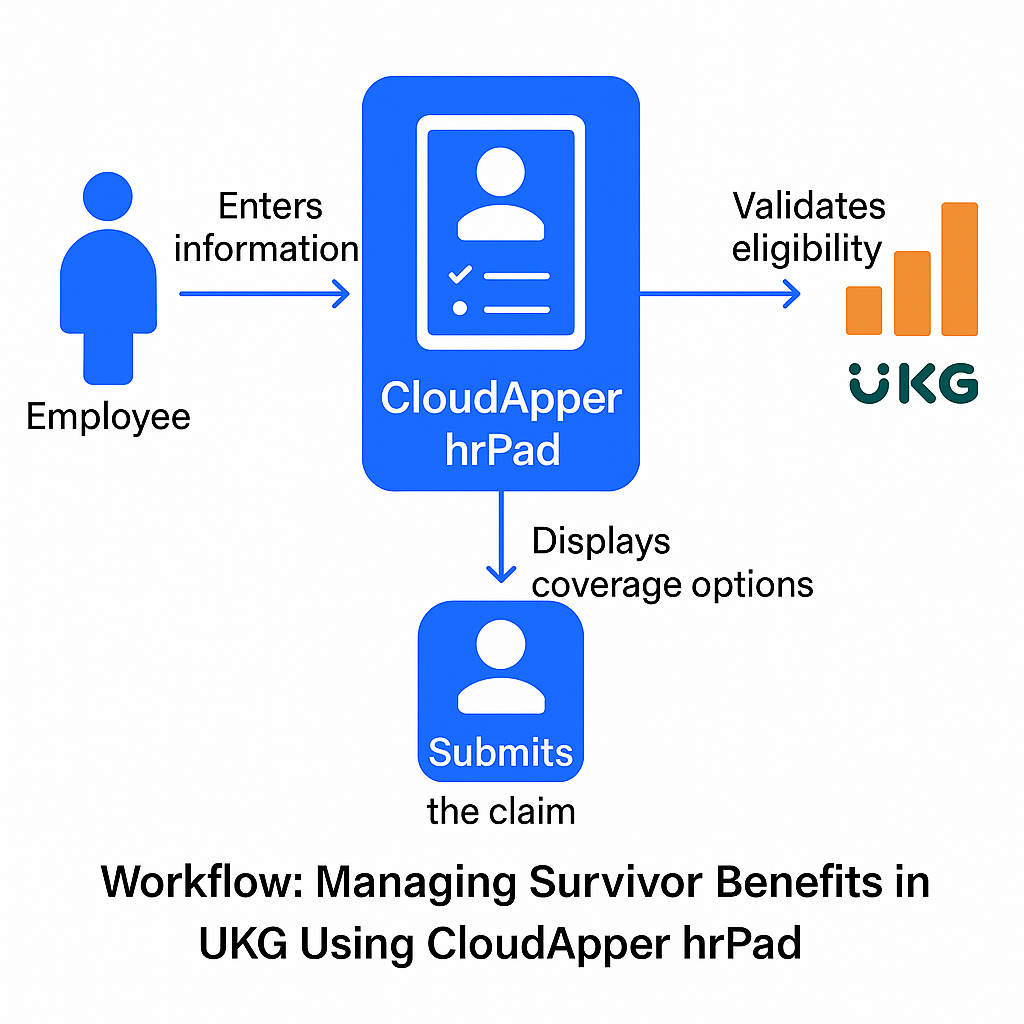

Upon receiving a death notification HR launches the hrPad “Survivor Benefits” case. Using UKG APIs the platform pre-loads employee, dependent, and plan data, then drives a five-stage checklist:

| hrPad Stage | Core Actions | Outcome |

|---|---|---|

| Case Builder | Generates unique case ID and secure workspace | All documents and tasks live in one repository |

| Secure Intake | Sends mobile upload link for death certificate and claim forms | Files attach to case and sync back to UKG in seconds |

| Task Orchestration | Drag-and-drop designer assigns due dates to Payroll, IT, Facilities, Legal | Every department receives time-stamped tasks; none are forgotten |

| Claim Dashboard | Tracks policy numbers, carrier SLAs, follow-up dates | HR leadership gains real-time visibility into payout progress |

| Audit & Closure | One-click export of documents, messages, and task history | Provides immutable PDF for DOL or carrier audits |

Because hrPad is no-code HR can modify the workflow whenever carriers change forms or state law adds requirements, without waiting for IT releases.

A healthcare network’s real-world numbers

A three-campus hospital group adopted hrPad after missing a pension notice deadline the prior year. Six months later an internal review produced the following comparison:

| Metric (per case) | Before hrPad | After hrPad |

|---|---|---|

| Average days from death to claim approval | 29 | 14 |

| Life-insurance claim rejections | 2.3 per 10 cases | 1.3 per 10 cases |

| HR help-desk tickets from beneficiaries | 4.1 | 2.6 |

| Auditor preparation time | 8 hours | 30 minutes |

The improvements stemmed from two design elements: every file uploaded by a beneficiary lands in UKG document storage instantly, and every touchpoint—call, e-mail, letter—links to the same case ID. During a Big Four audit the hospital exported a single PDF that contained the full timeline, documents, and task completion dates. The auditor accepted it as sufficient ERISA evidence because of its “consistent time-stamp lineage.”

Detailed illustration: Ten-day case timeline

| Calendar Day | hrPad Action | Responsible Area |

|---|---|---|

| 0 (notification received) | HR launches case; case auto-fills employee data | Benefits |

| 1 | Secure link sent; spouse uploads death certificate | Dependent |

| 2 | Payroll tasked; final wages and PTO queued | Payroll |

| 3 | IT deactivates user accounts; hrPad records completion | IT |

| 4 | Guardian Life claim form pre-populated; HR adds policy number | Benefits |

| 6 | Pension team generates beneficiary packet | Pensions |

| 8 | Carrier confirms claim receipt; status turns amber to green | Benefits |

| 10 | First payment date set; HR closes case and exports audit PDF | Benefits |

Every row is time-stamped automatically. If any step exceeds its SLA, hrPad escalates to the benefits director and records the escalation in the same log.

Why a complementary layer is superior to custom patches

Customizing UKG business-process rules could mimic parts of this flow, yet each update would require development cycles and retesting. hrPad leaves core configuration intact, reducing risk, while still leveraging UKG as the system of record. Data sovereignty remains with UKG; hrPad simply adds orchestration, visibility, and secure external channels.

Conclusion

Survivor-benefit gaps for UKG threaten payroll accuracy, compliance deadlines, and the employer’s reputation for empathy. CloudApper hrPad fills those gaps by adding a guided, auditable workflow that turns disjointed manual steps into a coordinated case file. The result is faster claim approvals, fewer errors, reduced audit prep, and—most importantly—families who experience a single, considerate point of contact during a difficult time.