CloudApper AI TimeClock integrates with UKG to streamline retro pay management, reducing administrative burden, compliance risks, and employee frustration. With accurate time tracking, automated notifications, and AI-powered features, it ensures error-free payroll and enhances employee satisfaction.

Table of Contents

Payroll accuracy is more than just an administrative duty — it’s the foundation of employee trust. When paychecks are even slightly off, employees lose confidence in HR, morale dips, and organizations face compliance exposure. Among all payroll errors, retro pay (retroactive pay) is one of the most common — and costly. It occurs when an employee’s pay needs to be adjusted after payroll has already been processed, whether due to late timesheet approvals, missed punches, rate changes, or forgotten bonuses.

While UKG provides a powerful framework for managing payroll, the process of handling retro pay manually can be labor-intensive and error-prone. According to the American Payroll Association, 80% of payroll discrepancies result from human error — often tied to timekeeping and manual retroactive adjustments.

This article explains what retro pay is, how it’s calculated, why it often leads to costly mistakes, and how CloudApper AI TimeClock for UKG simplifies the entire process through automation.

What Is Retro Pay?

Retro pay, short for retroactive pay, refers to the additional compensation owed to an employee for a previous pay period where their pay was miscalculated or underpaid. These adjustments happen when payroll has already been processed, but later changes affect how much the employee should have earned.

For example, if an employee receives a raise effective two weeks ago but payroll was already run, they are owed the difference between their new and old rate for those two weeks — that difference is retro pay.

Retro pay also applies when bonuses are issued late, shift differentials are overlooked, or timecard errors are corrected after processing. In UKG, these adjustments typically appear on the next paycheck as a separate line item labeled “Retroactive Pay,” ensuring full transparency and compliance with labor regulations.

How Is Retro Pay Calculated?

While the concept is simple, calculating retro pay accurately can be complex — especially in large organizations with multiple pay structures, shifts, and overtime rules.

The basic formula for hourly employees is:

Retro Pay = (New Pay Rate – Old Pay Rate) × Hours Worked at Old Rate

Example:

If an employee’s hourly rate increases from $20 to $22 and the change applies retroactively to a 40-hour week, the retro pay owed is:

($22 – $20) × 40 = $80

However, for hourly staff who worked overtime or earned differential pay, retro calculations must include additional elements such as:

- Overtime premiums under FLSA (the extra half-time for hours above 40)

- Shift differentials (e.g., night shifts or weekend bonuses)

- Commission or performance-based pay adjustments

Without automation, calculating these components manually can result in costly errors or underpayments. That’s where CloudApper AI TimeClock for UKG comes in — automatically detecting missed punches, late approvals, or rate changes and ensuring payroll accuracy every time.

The Hidden Costs of Retro Pay in UKG

Retro pay inaccuracies don’t just cause temporary frustration — they create a ripple effect across the organization. Here’s how:

1. Administrative Overload

Payroll and HR teams waste hours tracing missed punches, verifying rate changes, and recalculating past pay periods. Manual retro entries often require multiple verification steps, delaying payroll close and increasing stress.

2. Compliance Risk

Retro pay errors can easily trigger wage-and-hour compliance violations. Underpayment — even accidental — can lead to fines, audits, or employee grievances. Automation ensures every employee is paid fairly and every adjustment is fully documented.

3. Employee Morale & Retention

Pay errors erode trust fast. A G2 study found that 49% of U.S. employees would consider leaving after two payroll mistakes. Reliable payroll builds loyalty; repeated retro pay issues destroy it.

4. Financial Waste

Processing retro pay manually consumes time, resources, and can cause overpayments due to miscalculation. A single payroll error might seem small, but multiplied across pay cycles, the losses are substantial.

Among hourly wage earners, 26% have experienced underpayment, and 15% have faced delayed payments

The Smarter Way: Automating Retro Pay with CloudApper AI TimeClock

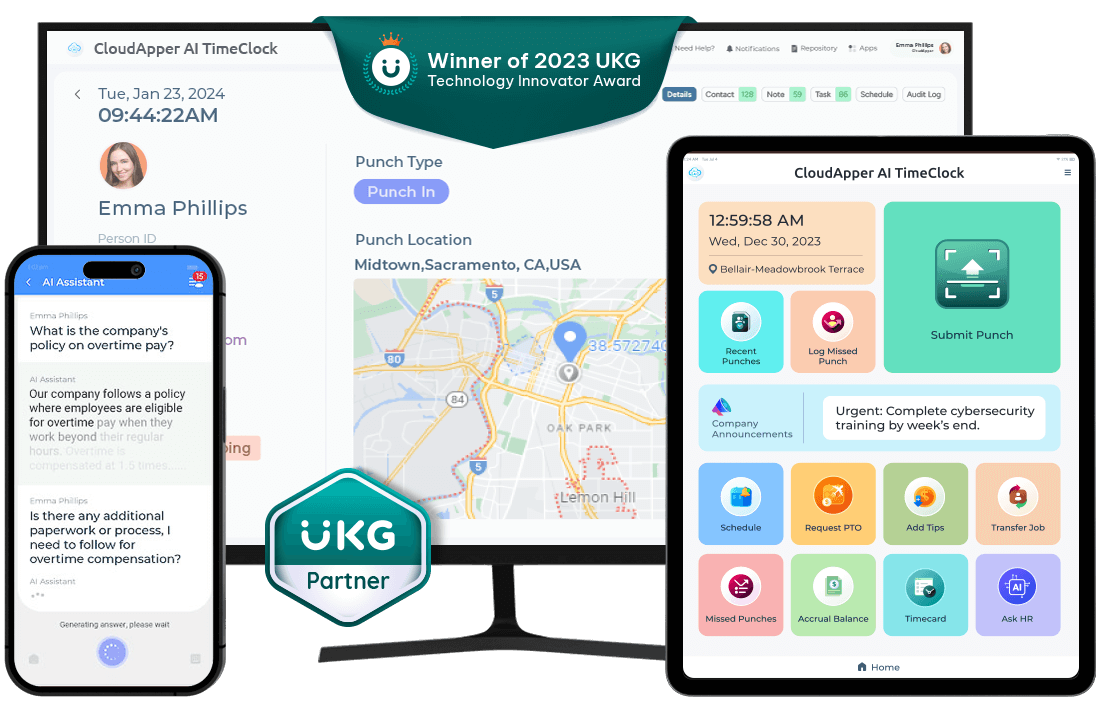

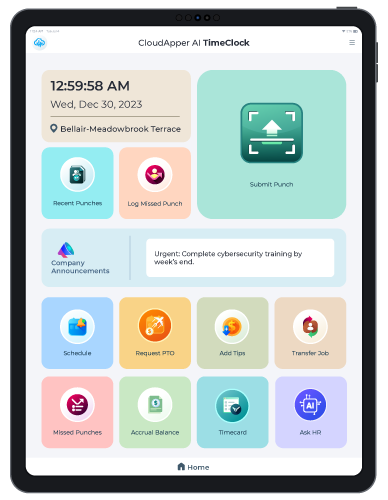

CloudApper AI TimeClock integrates seamlessly with UKG Ready, UKG Pro, and UKG Pro WFM (Dimensions) to simplify retro pay management from start to finish. It removes manual guesswork by ensuring every punch, rate change, and correction is captured accurately — before payroll even runs.

Here’s how CloudApper transforms the retro pay process:

AI TimeClock for UKG

Casino Workforce Management with CloudApper AI TimeClock for UKG

1. Accurate Time Tracking: The Foundation of Error-Free Payroll

Most retro pay issues start with inaccurate time data — missed punches, duplicate entries, or unverified transfers. CloudApper prevents that with multi-channel precision timekeeping:

-

Multiple Punch Options: Employees can clock in/out via facial recognition, QR code, PIN, or NFC tag.

-

Offline Mode: Field or remote workers can record time without internet access. Data syncs automatically once reconnected.

-

Custom Data Capture: Track job codes, cost centers, or project IDs to maintain detailed payroll records.

This accuracy eliminates the guesswork that leads to retroactive corrections.

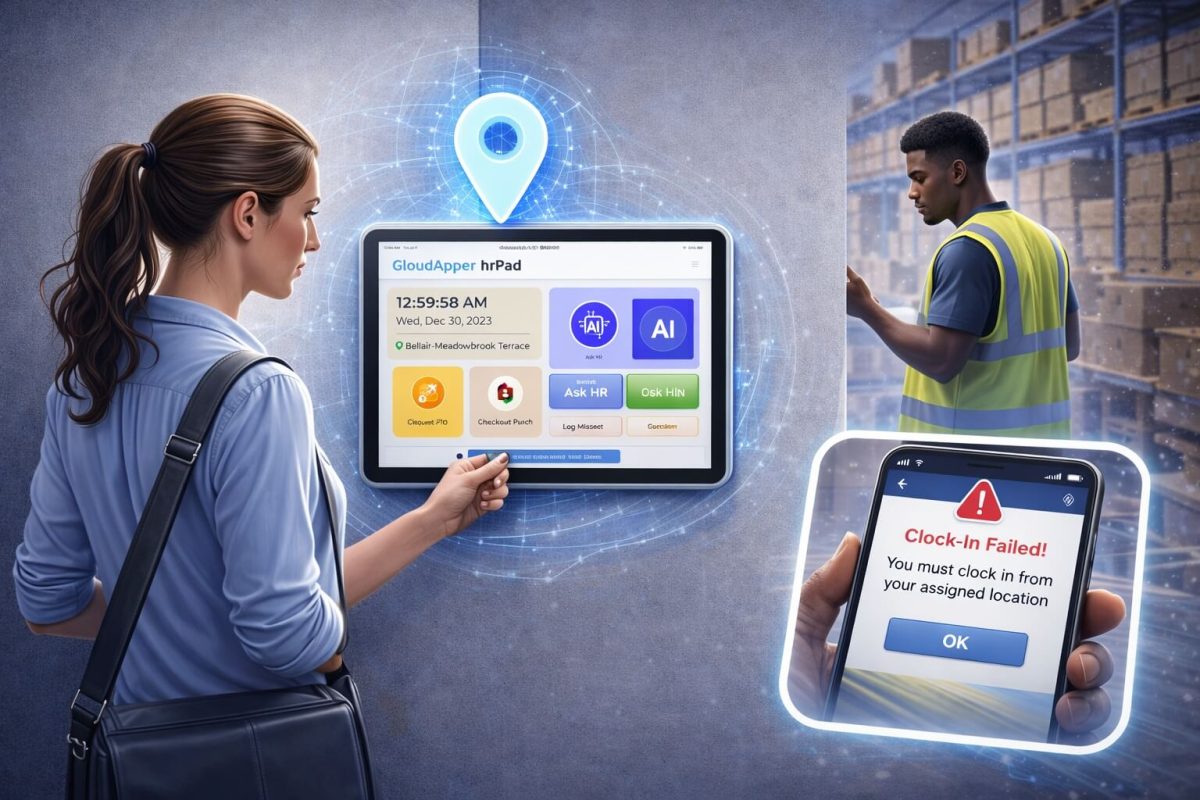

2. Automated Notifications and Manager Alerts

CloudApper ensures discrepancies are flagged before payroll closes — not after.

-

Missed Punch Alerts: Employees receive reminders to fix incomplete timecards.

-

Manager Notifications: Supervisors are alerted to exceptions instantly for review and approval.

-

Policy Enforcement: Prevents unauthorized time edits and enforces approval hierarchy automatically.

This proactive approach minimizes the chance of unreported hours or late adjustments that cause retro pay.

3. AI-Driven Retro Pay Management

The platform’s AI engine continuously monitors time and pay data to detect potential retro pay triggers such as:

- Updated pay rates not yet applied

- Delayed timesheet approvals

- Unpaid overtime hours

- Missed shifts or bonus entitlements

When discrepancies are detected, CloudApper automatically flags them, calculates the adjustment, and pushes the corrected data directly into UKG — creating a frictionless retro pay workflow.

Result: Payroll accuracy improved by up to 99.5% for customers using CloudApper alongside UKG.

4. Built-In Audit Trail for Compliance and Transparency

Every edit, punch correction, or pay change is logged with full traceability — who made the change, when, and why. HR teams can export detailed retro pay reports for audits or reviews.

This not only simplifies compliance but also helps organizations maintain clean, transparent payroll records — an essential factor during labor audits or legal disputes.

5. Seamless Integration with UKG Ecosystem

CloudApper doesn’t replace UKG — it enhances it.

The AI TimeClock connects with UKG Ready, Pro, and Dimensions using secure APIs to synchronize employee profiles, time data, and pay calculations.

It also integrates with other workforce management workflows like:

- Overtime tracking

- PTO and absence management

- Custom attestations for compliance documentation

The result is a single, unified system that keeps payroll accurate across all touchpoints.

Embrace Accuracy, Reduce Costs

By integrating CloudApper AI TimeClock with your UKG system, you can transform retro pay management from a complex and error-prone process into a streamlined and accurate function. Say goodbye to the administrative burden, compliance risks, and employee frustration associated with manual timekeeping. Contact CloudApper today to discover how our AI-powered time-tracking solution can revolutionize how you manage retro pay in UKG. Let CloudApper help you achieve error-free payroll and a more positive work environment for your employees.