As an employer, one critical aspect you need to ensure is accurate tip reporting. Employee tips are an essential source of income for many organizations, particularly in the hospitality and service sectors. However, when it comes to taxes, they can be a source of confusion and potential errors. The IRS requires employers to report all employee tips, as the latter is taxable income. Failing to report employee tips accurately can result in severe consequences, including penalties, fines, and legal action. Therefore, it’s crucial to have a streamlined process for managing employee tips, which is where CloudApper’s employee tip management solution for UKG comes in handy.

Accurate Tip Reporting is Essential

Keeping accurate records of employee tips is critical for tax compliance purposes. According to the IRS, employee tips are taxable and should be included in employee pay. Failing to report employee tips accurately can result in incorrect payroll calculations, which can lead to underpayment or overpayment of taxes. This can result in penalties, interest, and even legal action.

Moreover, inaccurate tip reporting can also lead to potential tax fraud, which can result in severe consequences for both the employer and the employee. For instance, if an employer fails to report tips accurately, the employee may not receive proper credit for the income earned, which can impact their Social Security and Medicare benefits.

CloudApper’s Tip Management Solution for UKG

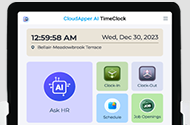

For UKG users, managing employee tips can be a hassle as there’s a lot of back and forth within the solution. However, CloudApper’s employee tip management solution for UKG simplifies the process of recording employee tips. The solution automatically sends the tip data to UKG, reducing several repetitive processes and saving time for everyone involved.

The Employee Tip Management Solution offered by CloudApper operates in two ways. Firstly, employees can input the tip amount themselves. This is facilitated by CloudApper’s custom time capture solution for employee punches. When employees clock out for the day, a pop-up appears on their screen, prompting them to enter the tips received. The data entered by the employee is then automatically transmitted to UKG Dimensions, eliminating the need for repetitive processes and manual data entry.

A manager can also manually input tip data into CloudApper’s Tip Management Solution for multiple employees at once. This process involves employees reporting their tips to the manager after their shift. Once the manager verifies the information, they can input it into the solution, which will automatically be sent to UKG Dimensions. This results in a seamless process that eliminates the need for manual data entry and saves time for everyone involved.

By streamlining the tip declaration and recordkeeping process, organizations can easily reduce the time and resources required to manage it. Moreover, the solution is highly customizable, user-friendly, and can be easily integrated with UKG Dimensions. Organizations can set up different access levels for employees and managers, ensuring that the data is secure and confidential. The solution also provides audit logs to record any changes made for future reference.

Benefits of Using Tip Management Solution

Easy-to-Use Solution: CloudApper’s easy-to-use interface provides UKG customers with a hassle-free way to record and manage employee tips. The solution is highly customizable, ensuring it fits the organization’s specific requirements.

Accurate Recordkeeping: With CloudApper, organizations can ensure that all employee tip data is recorded and stored in the system as well as in UKG. The solution eliminates the need for manual data entry, reducing the potential for errors and ensuring accuracy.

Better Tax Compliance: Accurate tip recording is essential for tax purposes as per the IRS, and CloudApper’s solution can help record all the information accurately. This ensures that the organization complies with tax regulations and avoids potential penalties or fines. The IRS requires employers to report all employee tips on a regular basis, and failure to do so can result in penalties, interest, and even criminal charges.

Conclusion

Accurate tip reporting is an essential aspect of UKG employers’ payroll and tax compliance processes. Failure to report employee tips accurately can lead to serious consequences, including hefty fines, legal penalties, and reputational damage. That’s why it’s essential to use solutions like CloudApper’s Employee Tip Management solution for UKG, which simplifies and streamlines the tip reporting process while improving accuracy, compliance, and cost savings. By implementing accurate tip reporting practices, UKG employers can avoid the risk of getting caught by the IRS and enjoy the benefits of improved business operations, employee satisfaction, and overall success. If you are planning to streamline your tip management. Contact us today.