As a business owner, keeping accurate records of employee tips is crucial for compliance with IRS regulations since tips are taxable income and need to be paid by the employees receiving them. However, if an organization experiences a high volume of transactions and has a large number of tippable employees, the calculation can become a cumbersome and time-consuming task. Fortunately, for UKG customers, the CloudApper Solution Community makes employee tip recordkeeping easy and hassle-free.

Let’s dive deep into why tip recordkeeping is necessary for applicable organizations and how CloudApper’s Tip Management solution simplifies tip recordkeeping by sending the data automatically to UKG.

Tip Management Can Be a Hassle

Manual tip recordkeeping and calculation can be a nightmare for business owners, especially in the hospitality industry, where tips are a major source of income for employees. As already mentioned, IRS mandates organizations to keep proper records of employee tips as they are taxable. Keeping track of cash and credit card tips can quickly become overwhelming and lead to errors – these can have serious consequences, including audits, penalties, and even legal action.

CloudApper’s Tips Management solution for UKG simplifies the process of employee tip recordkeeping – the solution can be configured to work in two ways.

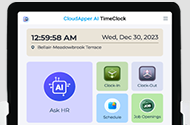

Firstly, UKG customers using CloudApper’s RightPunch, our custom time capture solution, can easily automate the tip declaration process during employee punches. When an employee punches out after their shift is over, they are presented with a pop-up where they can declare the amount of tips they received for the day. This data is sent to UKG automatically – helping keep records of the tips each employee receives without any manual entry.

On the other hand, if an organization wants, managers themselves can enter the amount of tips each employee receives – helping with verification as well. Whenever an employee’s shift is over, they simply report to the manager and declare the amount of tips they have received for the day. If needed, the manager can verify it and then enter the amount within the solution – the latter sends the data to UKG.

Simplify Employee Tip Management for UKG

Using CloudApper’s Tips Management solution helps UKG customers avoid legal and financial consequences and provides transparency and fairness for all employees.

In conclusion, employee tip recordkeeping is a critical aspect of business operations that can have serious consequences if not handled properly. CloudApper’s Tip Management solution for UKG customers simplifies the process, automating the dip declaration process and ensuring accurate recordkeeping. By using CloudApper, UKG customers can stay compliant with IRS regulations, simplify tip recordkeeping, and prevent fraudulent activities – contact us now to learn more.