Payroll compliance is crucial for organizations using UKG Pro. CloudApper automates payroll processes, reducing risks like miscalculations and classification errors, ensuring compliance with labor laws and tax obligations, and enhancing record-keeping for audits.

Table of Contents

Payroll compliance is a critical aspect of managing payroll operations effectively. Organizations using UKG Pro rely on it to process payroll accurately, manage tax obligations, and ensure compliance with labor laws. However, challenges such as payroll miscalculations, employee classification errors, and evolving regulatory requirements can pose risks.

CloudApper enhances UKG Pro payroll compliance by automating payroll validation, streamlining tax compliance, and ensuring accurate record-keeping. This article explores common compliance risks in payroll management and how CloudApper eliminates these challenges.

Common Risks in UKG Pro Payroll Compliance

Payroll Data Errors

- Inaccurate payroll entries can result in overpayments, underpayments, or miscalculations.

- Manual payroll adjustments increase the risk of compliance violations and processing delays.

Employee Classification Issues

- Misclassifying employees as exempt or non-exempt can lead to wage disputes and compliance violations.

- Incorrect classification of contractors versus full-time employees can impact tax filings and benefits eligibility.

Overtime and Wage Compliance Risks

- Payroll must comply with federal and state wage laws to ensure employees receive proper compensation for overtime hours.

- Inaccurate overtime calculations can result in penalties for non-compliance with wage regulations.

Payroll Tax Compliance Risks

- Payroll tax rates must be updated regularly to comply with federal, state, and local regulations.

- Late or incorrect tax filings may lead to financial penalties and audits from regulatory authorities.

Audit and Record-Keeping Challenges

- Payroll compliance requires maintaining detailed records for audits and legal requirements.

- Inconsistent documentation can increase the risk of compliance violations and legal disputes.

How CloudApper Ensures UKG Pro Payroll Compliance

CloudApper enhances UKG Pro payroll compliance by automating critical payroll processes and eliminating risks associated with manual payroll management.

Automated Payroll Data Validation

- Detects missing or incorrect payroll entries before payroll is processed.

- Reduces manual data errors, ensuring payroll accuracy in every cycle.

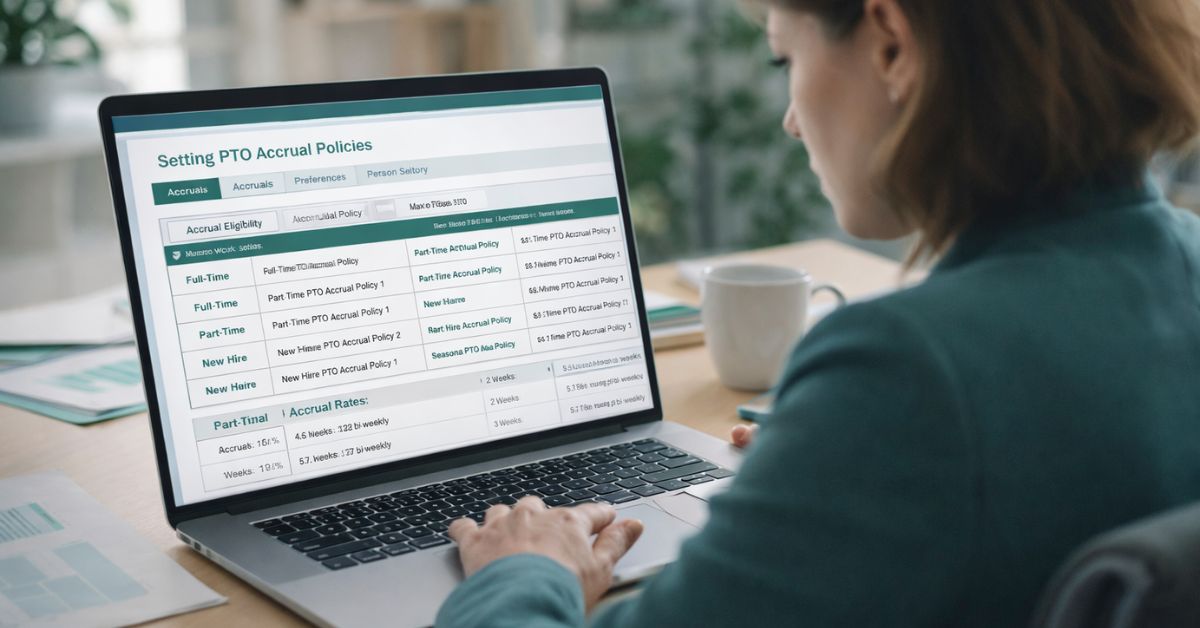

Employee Classification Verification

- Ensures employees are correctly classified as exempt, non-exempt, or contractors based on labor laws.

- Aligns payroll processing with company policies and wage compliance regulations.

Overtime and Wage Compliance Automation

- Applies accurate overtime calculations in accordance with labor laws.

- Ensures employees receive correct compensation for overtime and shift differentials.

Payroll Tax Compliance Tracking

- Syncs payroll tax calculations with updated federal and state tax rates.

- Prevents incorrect tax filings and ensures timely tax submissions.

Audit-Ready Payroll Compliance Reports

- Generates real-time payroll compliance reports for audits and tax filings.

- Maintains payroll records to ensure audit readiness at all times.

Real-World Use Cases: How CloudApper Supports UKG Pro Payroll Compliance

Retail Business Ensures Payroll Tax Compliance

A retail company operating across multiple states faced payroll tax discrepancies due to varying tax regulations. CloudApper automated tax rate updates and ensured compliance with regional tax laws, eliminating payroll tax errors and preventing compliance risks.

Logistics Company Improves Overtime Compliance

A logistics company struggled with inconsistent overtime calculations, leading to employee disputes. CloudApper automated overtime tracking and payroll adjustments, ensuring compliance with labor laws and eliminating payroll discrepancies.

Healthcare Organization Simplifies Payroll Audits

A healthcare provider needed an efficient system for payroll audits and compliance tracking. CloudApper provided automated payroll reporting and audit-ready documentation, reducing compliance-related workload and ensuring accurate payroll processing.

Why CloudApper is Essential for UKG Pro Payroll Compliance

- Automates payroll data validation, tax compliance, and employee classification.

- Ensures real-time payroll accuracy to eliminate processing errors and miscalculations.

- Enhances compliance tracking to align with evolving payroll regulations.

- Reduces payroll processing time by eliminating manual verification steps.

- Scales with enterprise payroll needs, making it ideal for businesses with multi-state operations.

Consult Our Experts Today

Ensure seamless UKG Pro payroll compliance with CloudApper’s automation solution. Contact us today for a personalized demo and eliminate compliance risks in your payroll operations.