Explore how CloudApper customizes UKG to fit unique payroll workflows for complex pay structures, rules, and team needs.

Table of Contents

Many HR professionals ask a common question when faced with complex compensation structures: Can UKG be customized to fit unique payroll workflows? The answer lies not just in the capabilities of UKG itself, but in how well it can be extended. While UKG offers robust payroll processing tools, adapting those tools to the specific workflows of your organization often requires something more—especially when juggling data from multiple departments or systems.

For organizations managing union rules, custom bonuses, multiple job roles, or variable pay rates, no out-of-the-box payroll system can cover every edge case. That’s where customization becomes critical. CloudApper makes it easier to mold UKG into a solution that mirrors your unique payroll structure—without hiring developers or rewriting backend code.

What Makes Payroll Workflows Unique?

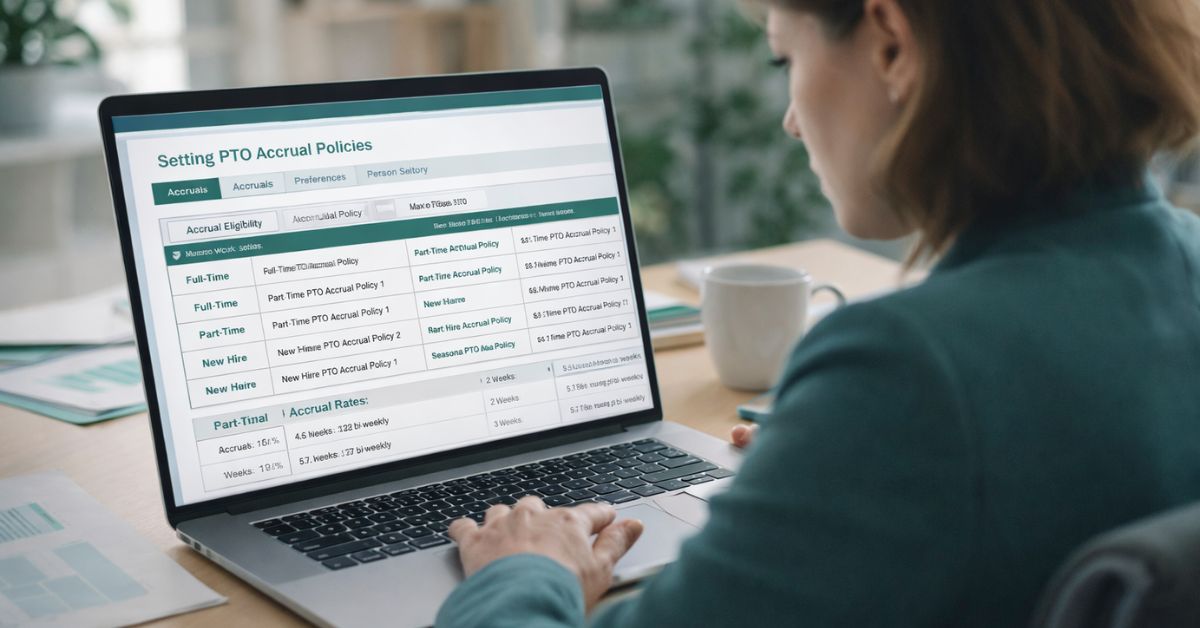

The term “unique payroll workflows” applies to companies with non-standard pay processes. Think tiered bonuses, shift premiums, job-based overrides, or retroactive adjustments. Each of these scenarios can introduce complexity that off-the-shelf systems struggle to support.

Take for instance a company operating in several states, each with its own tax and labor requirements. Or consider a nonprofit that pays employees differently depending on grant funding allocations. These examples require dynamic calculations, conditional logic, and flexible approval steps.

How Does CloudApper Support These Workflows in UKG?

CloudApper enhances UKG by creating logic, validations, and workflow steps that follow your payroll rules. Everything is tailored using a no-code platform, meaning HR or payroll admins can configure processes without writing a single line of code.

Let’s break it down:

-

Custom Pay Rule Automation: Whether you need to account for differential pay, bonuses, or stipends, CloudApper automates these rules so they apply consistently and correctly every time.

-

Multi-Step Approvals: Route payroll inputs for validation based on department, job role, or pay category.

-

Data Transformation: Convert time data, benefits, and overrides into payroll-ready formats that UKG accepts without errors.

-

Condition-Based Workflows: Trigger actions only when criteria are met (e.g., apply retro pay only if past hours exceed a threshold).

-

Custom Dashboards: Review and audit data before final processing, reducing errors and compliance risks.

Why Not Just Use Standard UKG Configurations?

UKG provides a strong framework for payroll. However, every organization has some level of customization that can’t be anticipated by a general configuration. Manually working around those gaps leads to inefficiencies and errors. With CloudApper, UKG becomes more adaptable and continues to work as your organization changes.

In the second half of payroll execution, CloudApper’s no-code platform adds another layer of flexibility—allowing teams to adjust rules or build new workflows as needs evolve.

Real-World Result

One logistics company customized their UKG environment using CloudApper to handle region-specific hazard pay. Without it, payroll had to track and adjust those calculations manually every week. After CloudApper’s setup, the system detected eligible shifts and calculated pay automatically—saving the team over 30 hours per month.

Expert Insight

“There’s no such thing as a ‘typical’ payroll anymore. You need tools that adjust to your structure—not the other way around,” says Jason R., an HRIS Manager at a healthcare network.

Final Thoughts

Every business has payroll quirks, and that’s okay. The question is whether your system can handle them. With CloudApper enhancing UKG, the answer is yes. Whether you’re scaling operations, handling unique labor rules, or supporting a mobile workforce, tailored workflows give you control and confidence in every pay run. Consult our experts today to learn how your unique payroll workflows can be fully supported within UKG.