Ensure IRS Compliance and protect your restaurant from steep penalties by automating employee tip tracking. CloudApper AI TimeClock integrates seamlessly with UKG Pro WFM, eliminating manual errors, reducing administrative burdens, and securing tax-free income benefits for your staff.

Table of Contents

One of restaurant managers’ many responsibilities is tracking and reporting the income, including tips, earned by tipped employees. Technically, it is the employee’s responsibility to track and report any gratuity income that exceeds $20 per month. This process can easily be automated with CloudApper AI TimeClock for UKG, which can ask employees to report their tips during clock-out, ensuring accurate and auditable tip data. How? Let’s dive in.

TL;DR:

-

High Financial Stakes: Inaccurate tip reporting triggers severe IRS penalties for both restaurant employers (heavy fines, back taxes, lost credits) and employees (50% tax penalties, lost deductions).

-

Seamless Integration: CloudApper AI TimeClock integrates directly with UKG Pro WFM to replace manual spreadsheets with an automated, tablet-based time tracking solution.

-

Real-Time Data Sync: The system allows staff to easily log cash, electronic, or pooled tips upon clocking out, automatically calculating necessary payroll taxes and withholdings in UKG.

-

Management Efficiency: By automating the tip tracking process, restaurants reduce administrative overhead, mitigate audit risks, and free up managers to focus on customer service and staff training.

Penalties for Being Non-Compliant with the IRS

With the passage of recent tax laws—which allow eligible workers to deduct up to $25,000 in qualified tips from their federal taxes—the IRS is monitoring tip reporting closer than ever. Now that the initial grace periods have ended, full enforcement is here. Failing to maintain accurate records carries steep, real-world consequences for everyone involved.

Employer Penalties

When a business fails to accurately capture and report tip data, the financial blowback can be severe:

-

Heavy Fines: The IRS charges steep penalties for every incorrect tax document submitted. If they determine the misreporting was intentional, those fines can snowball with no maximum limit.

-

Owing Back Taxes and Interest: If tips are hidden, the employer isn’t paying their required share of payroll taxes. During an audit, the business can be forced to pay all those missing taxes out of pocket, plus compounding interest.

-

The “Guesswork” Penalty: If your staff’s total reported tips fall below a certain percentage of your restaurant’s overall sales, the IRS forces the business to artificially assign extra tips to employees to make up the difference. This requires complicated math, upsets your staff, and acts as a magnet for deeper IRS audits.

-

Losing Valuable Tax Breaks: Many restaurants rely on specific tax credits tied to paying tipped employees. Sloppy recordkeeping can cause the IRS to take those credits away, costing the business thousands of dollars.

Employee Penalties

The stakes are equally high for the frontline staff, particularly under the newest tax rules:

-

Massive Tax Penalties: If an employee fails to report their tips, the IRS can hit them with a penalty equal to 50% of the specific taxes they originally owed on that money—on top of the original tax bill.

-

Missing Out on Tax-Free Income: Under recent tax changes, workers can deduct up to $25,000 of their tip income so it isn’t taxed—but only if those tips are officially reported through the business. If they bypass the time clock to hide cash, they completely forfeit this massive tax break.

-

Hurting Future Financial Health: Because tips are legally part of a worker’s wages, under-reporting makes their official income look much lower than it really is. This translates to smaller Social Security checks when they retire and makes it much harder to get approved for things like a car loan or a mortgage.

How CloudApper AI TimeClock Ensures Accurate Tip Tracking for IRS Compliance

Automated, Real-Time Sync with UKG Pro WFM

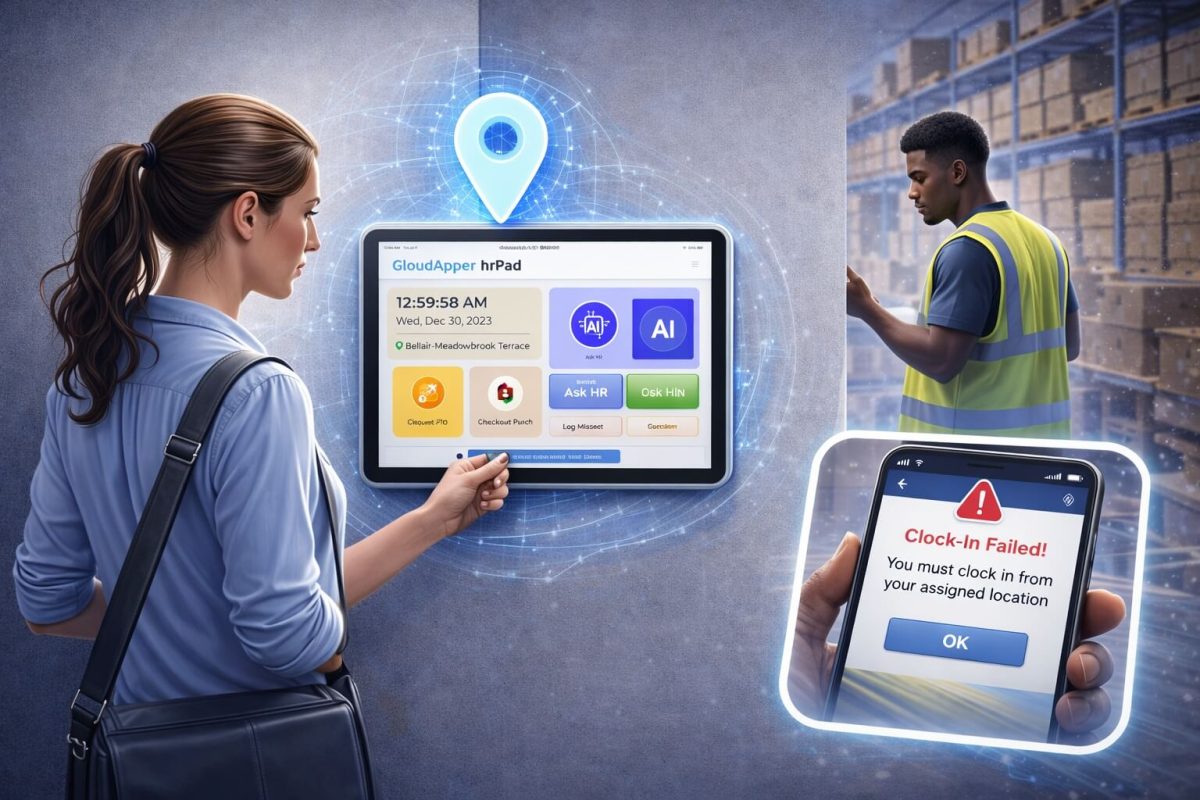

The CloudApper AI TimeClock leverages AI to automate the recording and reporting of employee tips. By integrating with UKG, the solution ensures that all tips, whether cash, electronic, or pooled, are accurately tracked in real time. Employees can log their tips directly into the system, which then calculates the necessary payroll taxes and withholdings.

Reducing the Administrative Burden for Managers

This integration offers significant benefits for both employers and employees. For restaurants, CloudApper AI TimeClock translates to increased efficiency and reduced administrative burden. Real-time tip data ensures accurate payroll calculations, minimizing the risk of errors and non-compliance fines. Additionally, the automated system frees up valuable time for managers, allowing them to focus on core responsibilities like customer service and staff training.

Empowering Employees with a User-Friendly Experience

CloudApper simplifies the tip tracking process for employees. The user-friendly interface allows for easy and convenient logging of gratuities, eliminating the need for manual records or cumbersome spreadsheets. This not only saves employees time but also fosters trust and transparency within the organization.

Frequently Asked Questions

-

What are the employer penalties for inaccurate tip reporting? Employers failing to accurately track and report tips can face steep fines for incorrect tax documents, owe back taxes with compounding interest, lose valuable tax credits, and be subjected to the IRS’s forced 8% tip allocation rule.

-

How does CloudApper AI TimeClock integrate with UKG? CloudApper AI TimeClock seamlessly integrates with UKG to provide an automated, real-time synchronization of tip data. When employees log their tips at the tablet kiosk, the data flows directly into UKG to accurately calculate payroll taxes and withholdings.

-

What happens to employees who do not report their tips? Employees who under-report their tips risk a 50% IRS penalty on the specific taxes owed. Furthermore, they forfeit their legal ability to claim up to $25,000 in tax-free income deductions and lower their verifiable income for future Social Security and loan applications.

-

Why should restaurants replace manual tip tracking with AI? Manual tip tracking relies on cumbersome spreadsheets and guesswork, making it a massive financial liability. AI automation guarantees accurate, real-time data entry, eliminating human error, fostering staff trust, and reducing the administrative burden on managers.

-

Can CloudApper handle different types of tips? Yes, the CloudApper AI TimeClock allows tipped employees to accurately log various types of gratuities, including cash, electronic, and pooled tips, ensuring comprehensive reporting for payroll.

Securing Your Bottom Line in the New Era of Tip Reporting

With the IRS strictly enforcing new tax laws, manual tip tracking is a massive financial liability. By integrating CloudApper AI TimeClock with UKG Pro WFM, restaurants can replace risky guesswork with an automated solution that bridges the gap between regulatory compliance and operational efficiency. This protects employers from heavy fines and lost tax credits, while empowering frontline staff to effortlessly secure their tax-free income without the hassle of cumbersome spreadsheets.

Beyond compliance, moving away from outdated manual tracking fosters staff trust and lifts a tremendous administrative burden off your managers, freeing them to focus on delivering exceptional customer service. Don’t wait for an IRS audit to expose the cracks in your payroll process.

Contact us today to schedule a demo of CloudApper AI TimeClock and transform any tablet into an automated compliance powerhouse