Struggling with multi-location tax compliance? Manual tracking wastes time, increases errors, and drives up costs. CloudApper hrPad automates everything—accurate payroll, real-time location tracking, and seamless UKG Pro integration.

Table of Contents

Let’s be real—tax compliance is a nightmare, especially when employees work across multiple locations. If you’re still handling it manually, you’re wasting time, increasing errors, and probably spending 30% more on admin costs than necessary. And who wants that?

But don’t worry, we’ve got the perfect fix—CloudApper hrPad, a self-service kiosk that integrates with UKG Pro to automate multi-location tax compliance. No more tax headaches, just smooth, seamless payroll processing. Here’s how it works.

Why Multi-Location Tax Compliance is a Pain

Today’s workforce is more flexible than ever—people work remotely, switch between offices, or even cross state lines. While this is great for business, it creates chaos for payroll and tax compliance. Each location has different tax rules, and tracking everything manually? A recipe for disaster. Enter CloudApper hrPad—your AI-powered tax compliance superhero.

How CloudApper hrPad Makes Tax Compliance Effortless

Auto-Track Employee Locations (No More Guesswork)

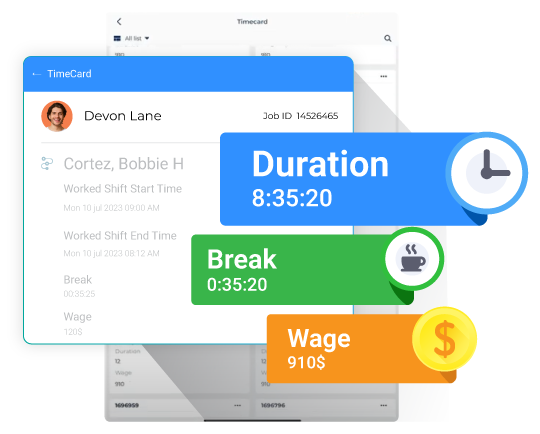

Employees clock in and out using geofencing and GPS tracking, and hrPad syncs everything with UKG Pro in real time. That means accurate tax calculations and zero manual adjustments—saving your HR team hours of work.

![]()

Automatic Cost Center Updates (Because Accuracy Matters)

When employees move between work locations, hrPad automatically updates cost centers in UKG Pro. No manual tracking, no errors—just flawless payroll processing every time.

Built-In Compliance & Payroll Accuracy

Tax laws change, but hrPad keeps you compliant by syncing real-time location data with payroll. That means no surprise penalties, no tax mishaps—just stress-free payroll.

Instant Reports & Hassle-Free Audits

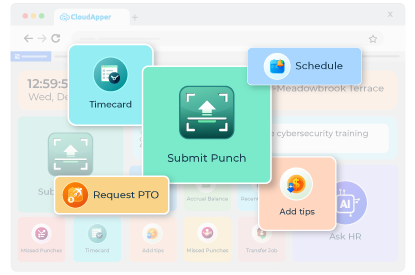

Need quick access to where employees worked and what taxes apply? hrPad’s real-time custom reports make payroll audits faster, easier, and more accurate. No more last-minute scrambling before tax season.

Employee Self-Service = Fewer Payroll Errors

Employees can verify their work location before payroll processing, ensuring accuracy and fewer corrections later. HR teams can override or adjust locations if needed—giving everyone peace of mind.

Why You Should Automate Tax Compliance NOW

Manually tracking tax compliance is costly, time-consuming, and prone to errors. With CloudApper hrPad, you can:

- Reduce admin costs

- Ensure tax compliance across multiple locations

- Eliminate manual payroll corrections

- Save your HR team HOURS of work

Take Control of Multi-Location Tax Compliance Today!

Stop letting tax complexities slow you down. Automate everything with CloudApper hrPad and make tax compliance effortless. Ready to see how it works? Let’s get started!